EIN Lookup How to Find Your Business Tax ID Number NerdWallet (2023)

Sign In to make an Individual Tax Payment and See Your Payment History. For individuals only. You will need to create an IRS Online Account before using this option. View the amount you owe, your payment plan details, payment history, and any scheduled or pending payments. Make a same day payment from your bank account for your balance, payment.

Documents needed for efiling Tax Return at Rs. 499 only. Moneymarine Tax Return

When you receive more than $10 of interest in a bank account during the year, the bank has to report that interest to the IRS on Form 1099-INT. If you have investment accounts, the IRS can see them in dividend and stock sales reportings through Forms 1099-DIV and 1099-B. If you have an IRA, the IRS will know about it through Form 5498.

How long can I be negative in my bank account? Leia aqui What happens if my bank account is

Instead, call the IRS e-file Payment Services right away at 1-888-353-4537 (They're open 24/7). You may be penalized if your tax payment isn't received by the filing deadline, so don't delay. For problems with state tax payments, contact your state tax agency. What if I entered the wrong bank account for direct deposit?

How to file your taxes online with True North

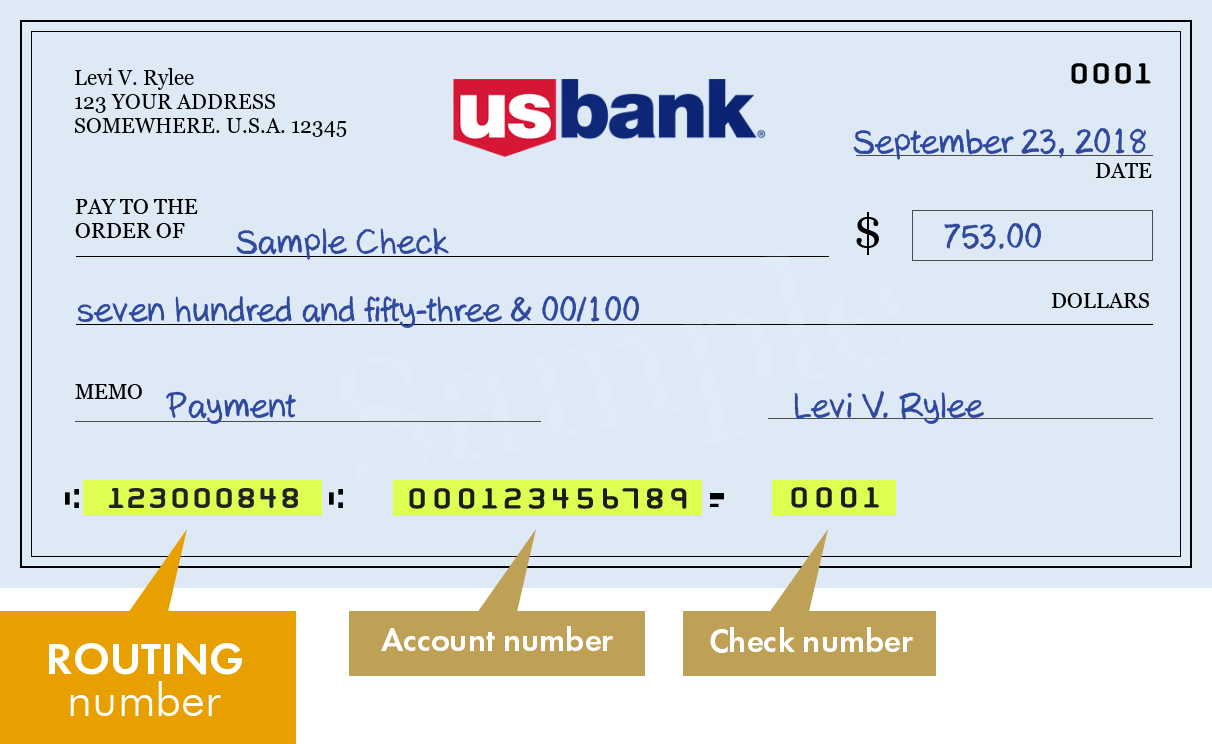

You'll need the routing and account number, which you can get by calling their customer service number. Open a bank account. Once you've opened your account, come back to TurboTax to enter your bank account information, and then e-file to get your refund as quickly as possible. Opt for a check refund.

How to open a bank account without ID UK YouTube

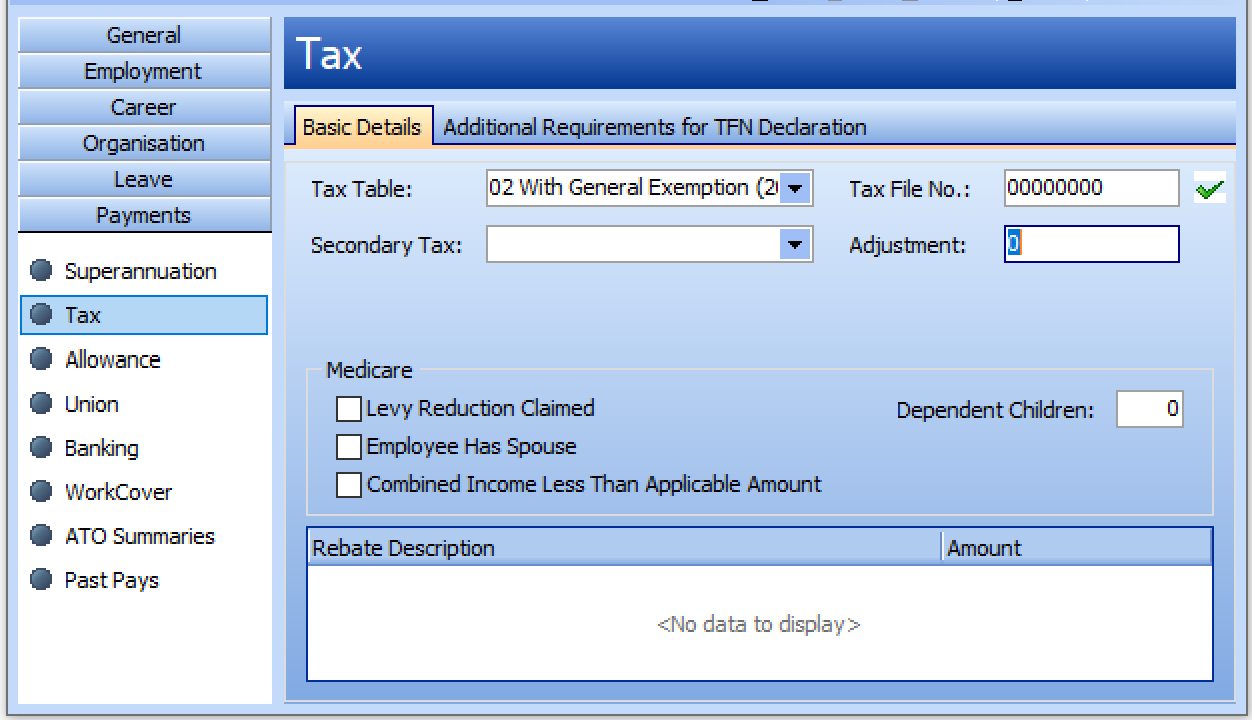

Identity documents. The identity documents you need to apply for a TFN, ABN or register for GST and who can certify your original documents. 22600. How to apply for a tax file number (TFN), update your TFN details, where to find your TFN and what to do if it's stolen.

How to everify your tax return using net Banking YouTube

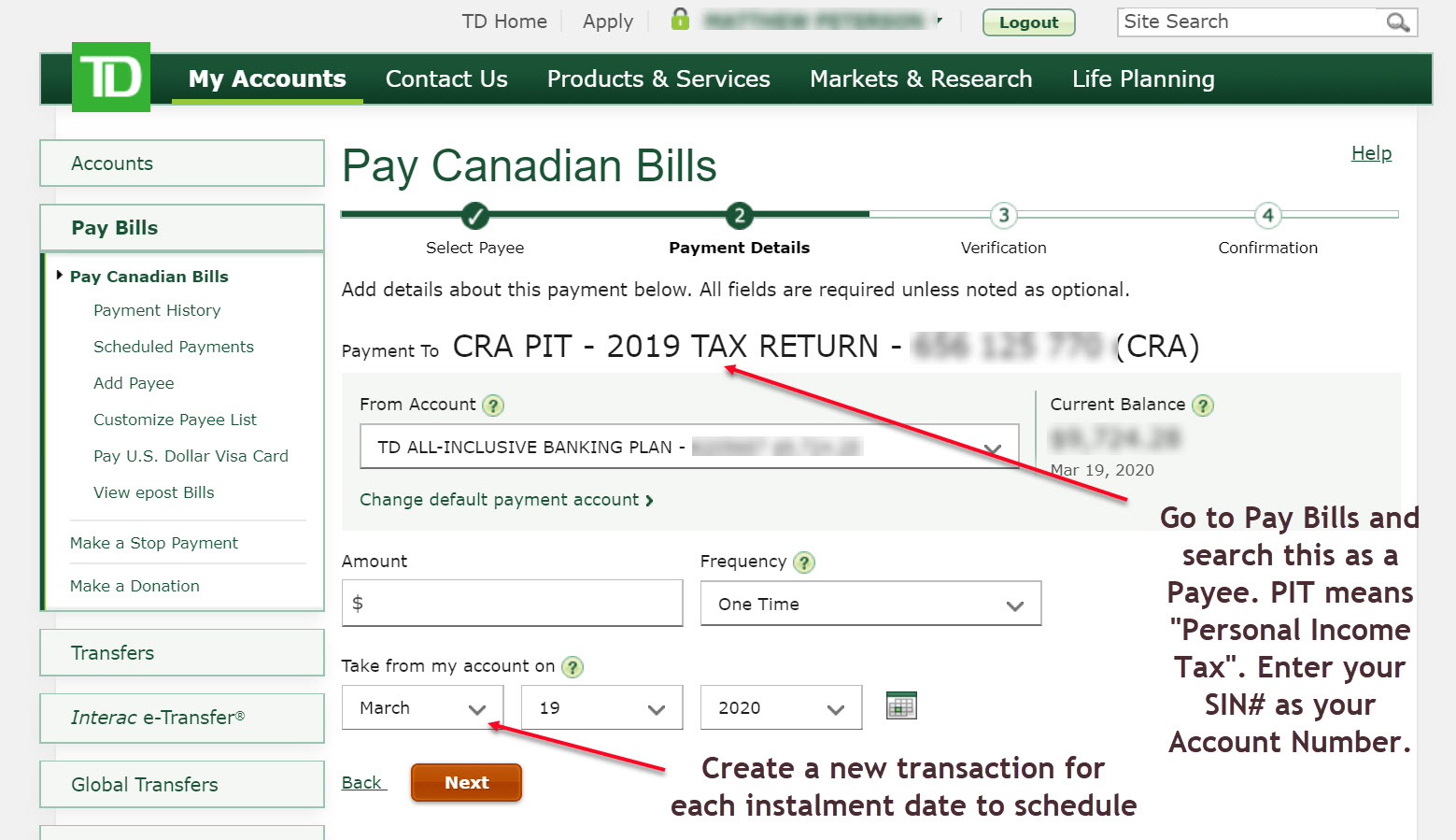

If you owe additional taxes to the IRS and you're e-filing, enter your bank account info on the How would you like to pay your federal taxes? screen (choose the first option, direct debit). Direct debit isn't an option for paper-filed federal returns. To review previously entered bank account info, revisit the File section in TurboTax.

FAQ Can I see my refund amount and payment date or the payment due date of the amount owed by

If you do nothing, then the IRS would be able to take money out of your bank account once the 21 days are up. During the 21-day waiting period, any funds in the account are frozen. Any new funds added after the waiting period begins would still be accessible to you. Assuming there are no conflicts of ownership with the account, the levy can.

ITR 2022 10 documents you must have before filing tax return BusinessToday

Any U.S. citizen with foreign bank accounts totaling more than $10,000 must declare them to the IRS and the U.S. Treasury, both on income tax returns and on FinCEN Form 114. The Foreign Account.

Wondering about how to cash a check without a bank account? This article will give you the many

The latest tax fight, explained. A battle over taxes continues to brew as the IRS is seeking to obtain more bank account information, a move strongly opposed by Republicans and the lenders.

How to Find Your Bank Account Number Update 2022

Tax file number (TFN) withholding tax. If your bank doesn't have your tax file number (TFN), it will withhold tax from your interest at the highest marginal tax rate. You can claim a credit for the amount of tax withheld when you lodge your tax return. You don't need to provide your TFN if: you are under 16 years of age; the account is in your name

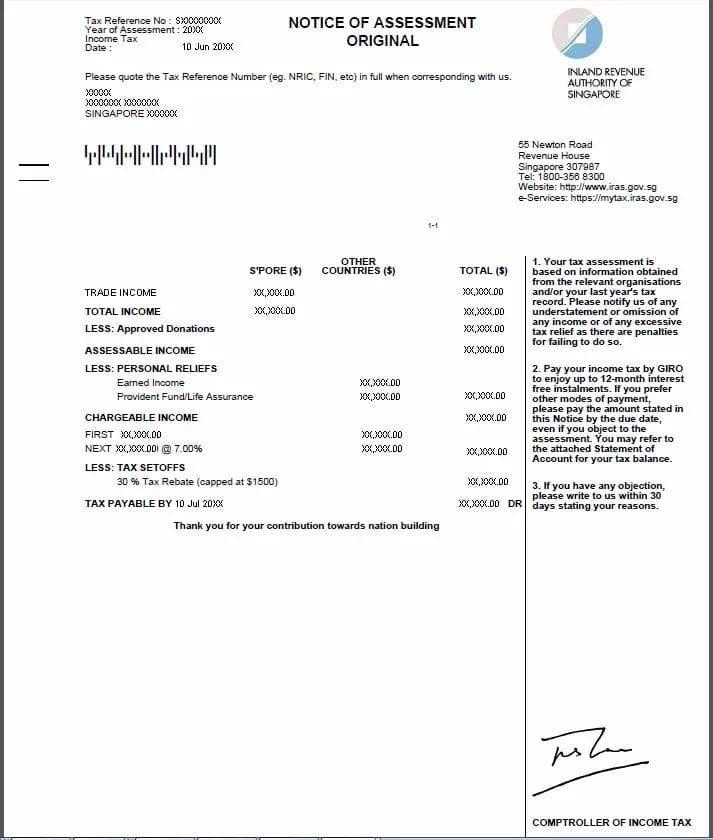

How To File Tax Clearance Singapore Asbakku

Document requirements may vary from bank to bank. When opening a bank account in the U.S., non-residents may need to provide identification, proof of address and possibly an opening deposit. Contact your bank to confirm what documentation is needed. Here are some items that you may need to open an account:

Employees Without Tax File Numbers Agrimaster

Withholding tax on a savings account is calculated at the top marginal tax rate of 45% with the additional Medicare levy of 2.5%. Withholding tax also applies to non-residents of Australia as well, and for them, the tax rate is 10%. If you forgot to supply your TFN, it's not the end of the world. You can claim a tax credit for any withholding.

Routing Number For Us Bank Examples and Forms

Tax professionals, with proper authorization to access the Transcript Delivery System, can also enter a Customer File Number to display on the transcript. Here's how it would work for a taxpayer seeking to verify income for a lender: the lender will assign a 10-digit number, for example, a loan number, and it will be entered on Form 4506-C.

How Can I Get My Tax File Number Again Tax Walls

CommBank app. Log on to the CommBank app. Go to the menu in the top left. Tap Profile, then Tax File Number. Choose one of the options from the drop down. Tick each account you want to apply it to, then tap Submit.

Bank Of America Check Account Number Bank Choices

We're here to help. Withholding tax may apply to interest earned on your account (s) unless you've provided us with your ABN, TFN or TFN exemption. You're not obliged to provide your ABN, TFN or TFN exemption but if you don't, we're required by law to withhold tax.

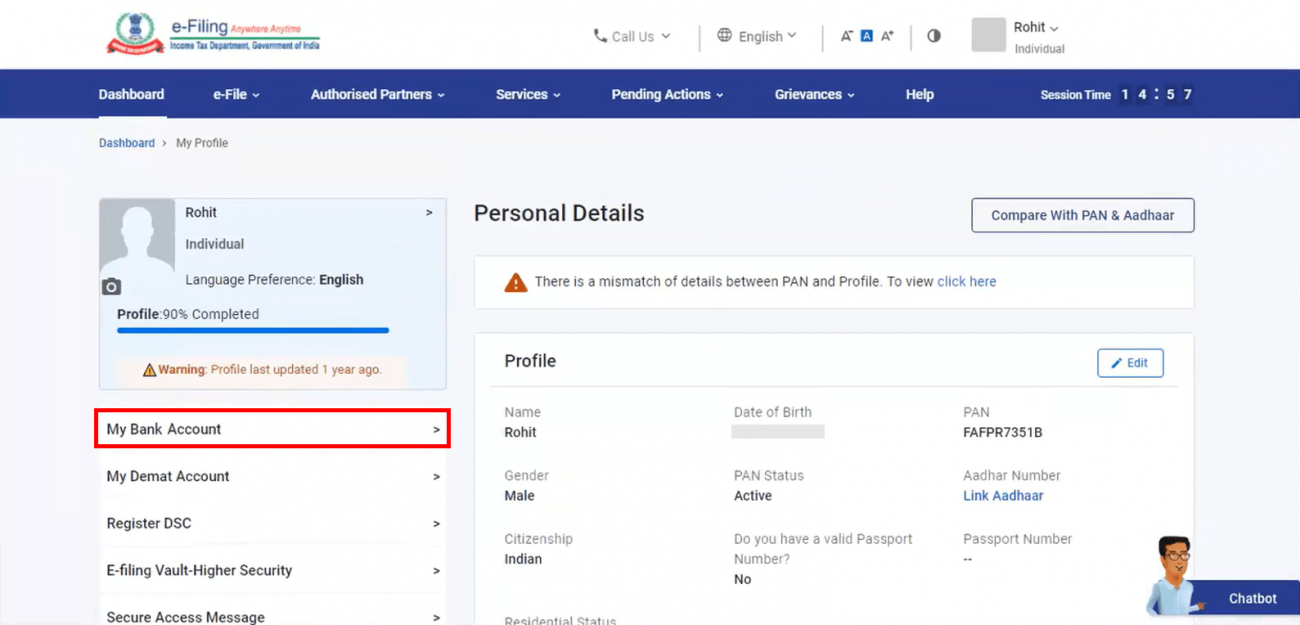

How to Prevalidate Bank Account Details on Tax Portal Learn by Quicko

The account must be held by: you under your legal or trading name, either solely or jointly; your registered tax or BAS agent; a legal practitioner acting as your trustee or executor. When providing your account details, we require the: bank state branch (BSB) number - this number has 6 digits; account number - this number has no more than.