State extends tax filing deadline to May 17

When is the Australian tax return deadline? The key date you need to know is: October 31. October 31 is the tax return due date if you're lodging your tax return yourself for the previous financial year (July 1 - June 30). You can lodge your tax return through H&R Block's Online Tax Express Return, which is quick and easy to use, and gives.

June 2023 Tax Calendar CloudCFO PH

The 2023 tax return deadline has passed, but we can still help! You must lodge a tax return if you earned ANY income between 1 July 2022 - 30 June 2023. Skip to primary navigation;. Australian tax laws authorise the ATO to apply penalties of $313* for the following offences:

IRS Tax Deadline 2023 What time are taxes due on April 18th? Marca

The deadline for submitting your PIT is getting closer. Everyone who earned taxable income in 2023 should settle their PIT by April 30 this year. Submitting tax returns on time allows you to avoid unpleasant consequences, i.e. fines in the form of interest charged for each day of delay.

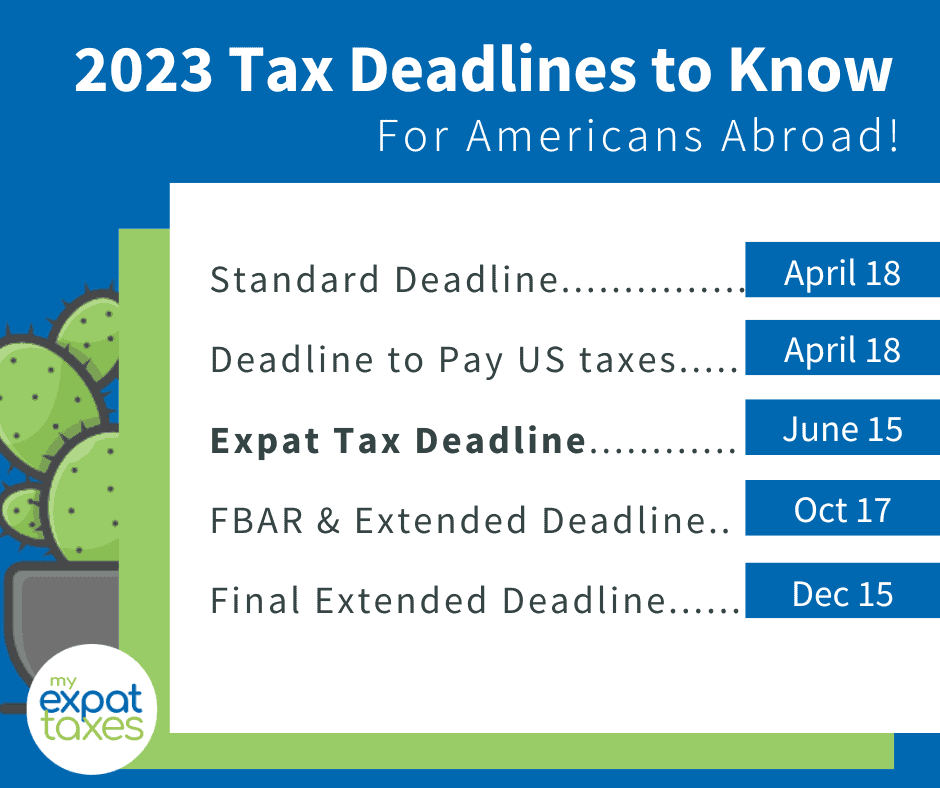

2023 Tax Deadlines and Extensions for Americans Abroad

The LMITO was introduced in the 2018/2019 Federal Budget. For example, those earning between $40,001 and $90,000 qualified for a full $1500 offset (others qualified for a lesser amount, depending on their income levels). Unfortunately, LMITO expired on 30 June, 2022. So if you notice that your tax refund is lower in 2023, the reason is likely.

Tips to get a Bigger Tax Refund this Year Money Savvy Living

Lodgement deadline. As always, the lodgement deadline for people who prepare their own tax return is October 31. If you miss the deadline, the maximum penalty is a maximum of 5 penalty units of $313 each. Therefore, the maximum penalty is $1,565.

Irs Updates On Refunds 2023 Calendar 2023 Get Calender 2023 Update

Filing your tax return on time is crucial to avoid penalties and inconveniences. For the tax return 2023, the key dates are as follows: 1st July 2023: The beginning of the new financial year. 1st July 2023 to 31st October 2023: The official tax return period. 31st October 2023: The deadline for individual tax returns.

LLC Tax Filing Deadline Small Business Tax Deadlines for 2023

Tax time 2023 for businesses - your questions answered. Article from the ATO. Last updated 18 Oct 2023 · 9,022 views. Print friendly. Let's get down to business. Doing your 2023 business tax return doesn't need to be complicated. Lodging online is a convenient, secure and reliable way of getting the job done.

Important Tax Deadlines for 2023 Market Street Partners

Key dates in lodging your income tax return: 1 July 2023. From this date, you are able to begin completing your 2023 tax return. Mid-July 2023. ATO Prefill Reports will be available for you to pre-populate fields in your Airtax Tax Return. 31 October 2023. ATO deadline for 2023 Income Tax Return lodgement.

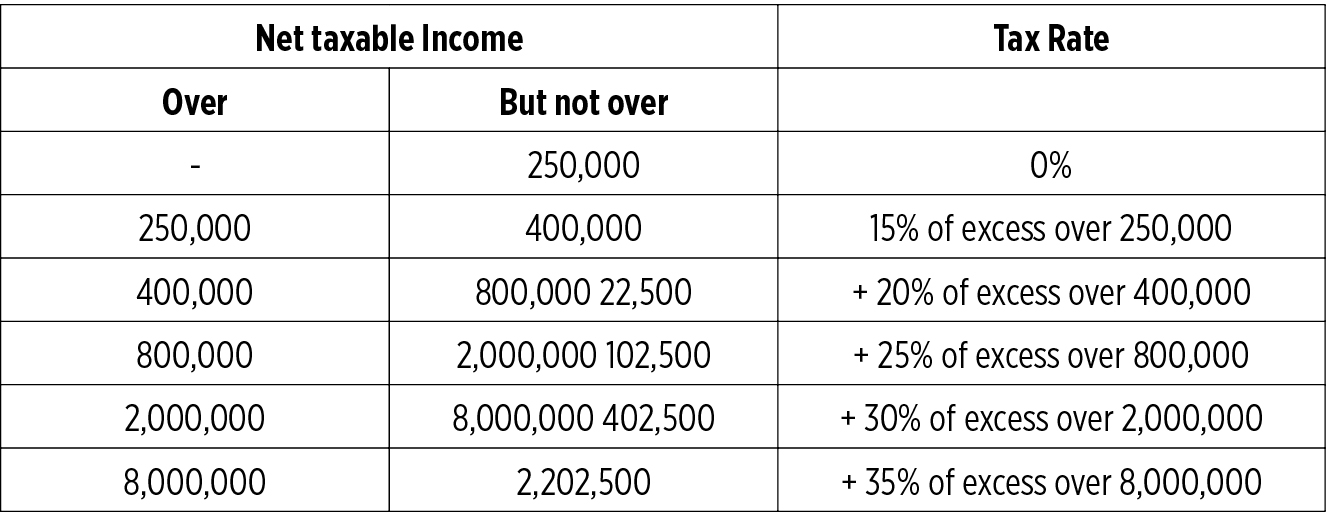

Endings and beginnings Yearend tax reminders and tax changes in 2023 BusinessWorld Online

15 May following the 30 June year end (so 15 May, 2023, for FY21/22 tax returns) 31 March if you have prior-year tax liabilities greater than $20,000. You can find out more about how to lodge a tax return in Australia, plus what's new for individuals lodging a tax return for the 2021/22 financial year.

:max_bytes(150000):strip_icc()/balance-tax-return1-8b74d7fde2b44e5baa394d2ceda7d730.jpg)

Federal Tax Deadlines

Lodge your tax return by 31 October 2023. If you're lodging your own tax return, you need to lodge it by 31 October each year. If you choose to use the services of a registered tax agent, they will generally have special lodgment schedules and can lodge returns for clients later than 31 October. If you are using a registered tax agent, you.

January 2023 Tax Deadlines

Tax time 2023 - your questions answered. Article from the ATO. Last updated 25 Jan 2024 · 10,156 views. Print friendly. This tax time, we want you to lodge right. So, if you're preparing your own tax return, we've got you covered! We're here to help and answer all your commons tax time questions. How do I find my tax file number (TFN)?

Tax Form Deadlines 2023 Printable Forms Free Online

31 October 2023. This is the tax return deadline for individuals, sole traders, freelancers and trusts to lodge their returns with the Australian Taxation Office (ATO). Pro tax tip: If you or your small business use a tax agent, you have a bit more time. Note that the 15 May deadline can be extended to individual taxpayers, but only if the tax.

IRS Extends Tax Filing Deadline to October 16, 2023

So if you haven't yet filed your return for the 2022/23 financial year, the deadline is 15 May 2024 when submitting through an agent. However, different rules apply if you lodge through a tax.

Tax Deadlines for Q1 of 2022 Holbrook & Manter

If you are lodging your own tax return, you have to submit it by October 31, 2023. This is a strict deadline, and if you don't meet it, you could be fined hundreds of dollars. However, if you have.

SARS makes changes to the 2020 tax filing season Zululand Observer

Though, yes, penalties are absolutely on the cards. "Self-lodgers who fail to lodge a tax return by 31 October could be hit with an immediate late lodgement penalty of $222, increasing by a.

Tax Return Australia Que no se te olvide [Guía al grano]

As of the end of September, 7.9 million Australians had lodged their tax returns —400,000 fewer than the same time last year according to the Australian Taxation Office (ATO).

- A Match For The Prince Watch Online Free

- Sonny And Cher Halloween Costumes

- Pine Beach Hotel Emu Park Qld

- Owl City Carly Rae Jepsen Good Time Lyrics

- Lukas Nelson Promise Of The Real Find Yourself Lyrics

- Where To Watch Emmys 2024 Australia

- Where Is Canvey Island Uk

- The Newsreader Cast Season 2

- Age Of Criminal Responsibility Victoria

- Jake Paul Vs Tommy Fury Australia Time