Capital Gains Tax Archives House of Wealth

In Australia, retirees do pay capital gains tax when selling an investment property. However, retirees are likely to pay less in capital gains tax than pre-retirees, due to assessable capital gains being added together with all other forms of taxable income before tax is calculated at marginal rates. Therefore, as a retiree does not have an.

How to Avoid Capital Gains Tax on Investment Property Pherrus

A capital gain on a personal use asset is subject to CGT if it cost you more than $10,000 to acquire the asset. Capital losses on personal use assets are ignored. This means you cannot use a capital loss on a personal use asset to reduce capital gains on other assets (including other personal use assets).

Capital gains tax on shares in Australia explained

High long-term capital gains tax rate: 10.75%. New Jersey ranks just below Minnesota, with a high tax rate of 10.75%. The 10.75% rate applies to all taxable income of $1 million or more for single.

PPT Capital Gains tax in Australia PowerPoint Presentation, free download ID1353523

Yes, self-funded retirees do pay capital gains tax in Australia if they sell an investment for more than they purchased it for. The same capital gains tax (CGT) rules apply to self-funded retirees as all other Australians. However, because a self-funded retiree will generally have lower overall taxable income, the assessable capital gain could.

Calculating Capital Gains Tax (CGT) in Australia

However, other property and land taxes may apply. Do retirees pay capital gains tax in Australia? While retirees and pensioners are free from a number of costs, unfortunately capital gains tax isn't one of them. Retirees and pensioners are still subject to CGT, unless they qualify for an exemption. These include:

Do Senior Citizens pay Capital Gains Tax When Selling Their Homes in [target_state]? These

Capital gains tax (CGT) is the tax you pay on profits from selling assets, such as property. You essentially make a capital gain when the difference between the cost of purchasing your property (or another asset) and what you gained from selling it is greater than zero - in other words, you made a profit. If you received less than the cost base.

Make taxfree capital gains on Australian shares whilst a nonresident expat Expat Taxes Australia

In that event, only the first $20,000 of long-term capital gains would be taxable at 0%. If their taxable income were $35,900, up to $40,000 of long-term capital gains would enjoy the 0% rate.

Understanding Capital Gains Tax A Comprehensive Guide

Self-funded retirees do pay tax in Australia and are required to lodge a tax return in certain instances. The main types of taxes a self-funded retiree may be required to pay includes personal income tax, capital gains tax or tax within superannuation. Let's take a look at each of these individually. Learn More: How Much Tax Do Self-Funded.

Easy way to calculate capital gains tax on DRIP shares

Australian retirees don't pay capital gain tax through super if they use it to kick off their retirement returns. But if you allow your super to accumulate after retirement, capital gains tax will be in effect and must be settled. This needs further clarification because two separate guidelines determine how tax is calculated for you as a.

How to disclose Capital Gains in Tax Return

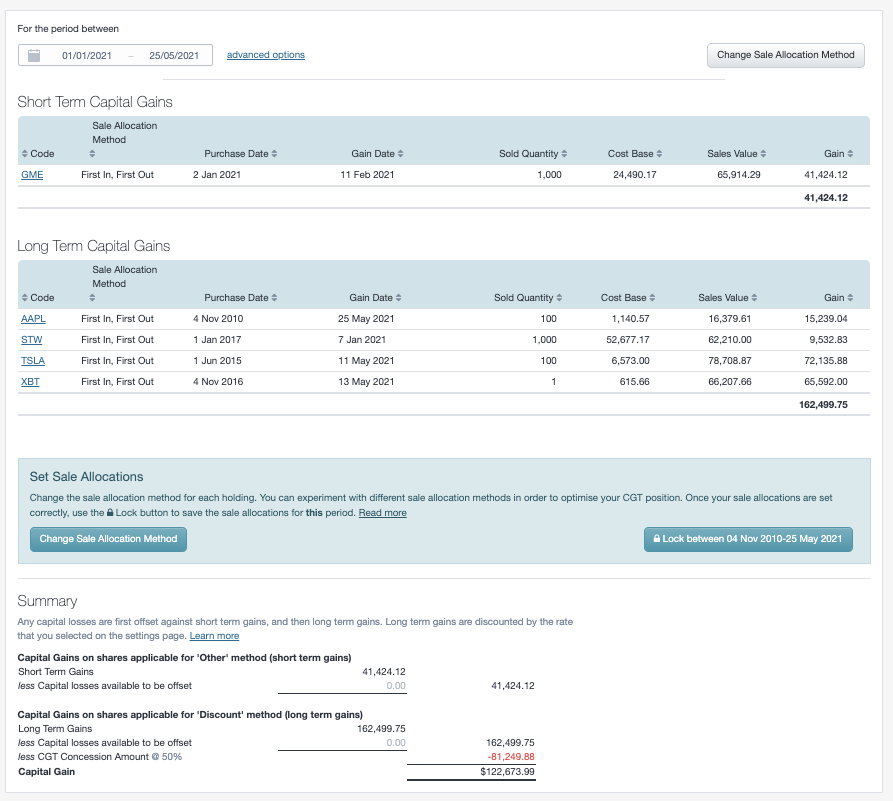

CGT Discount. The ATO or the Australian taxation office offers a CGT discount that may allow you to reduce your capital gain by 50%. For this, you must fulfil the following two conditions: You kept the asset for at least a year (12 months) before the CGT event. You are considered an Australian resident for tax purposes.

Definitive Guide To Capital Gains Tax In Australia

Yes, Australian retirees are still required to pay CGT. There is no age limit exemption that allows seniors to avoid paying CGT. The ATO treats capital gains as part of your overall taxable income. So even after you enter your pension phase and are no longer earning a salary, you still must report capital gains and losses on your annual income.

Do retirees pay capital gains tax in Australia? Expat US Tax

Retirees still have to pay Capital Gains Tax in Australia, unless they qualify for another exemption. It's a common myth that retirees, pensioners or over 65s don't have to pay CGT, but unfortunately, there is no age limit to CGT in Australia. However, assets purchased before 20 September 1985 are exempt, and exemptions apply for certain.

When Do You Pay Capital Gains Tax On Property in Australia? WealthVisory

Market valuation of assets. You must obtain market valuation of an asset when required by tax law. The valuation must be objective and supportable. How to calculate capital gains tax (CGT) on your assets, assets that are affected, and the CGT discount.

How Much is Capital Gains Tax in Australia The Key Facts OdinTax

Simply put, yes, retirees pay capital gains tax in Australia. However, being a retiree does make one eligible for certain exemptions and concessions, particularly in regards to the sale of property or a business. Navigating the complexities of capital gains tax in Australia is crucial for retirees, especially when it comes to understanding the.

Explained Capital Gains Tax (CGT) in Australia YouTube

The key difference to the tax treatment depends on whether your super account is in accumulation phase or pension phase. If you are in the accumulation phase… when you are still working and growing your super, the maximum tax rate is 15%. However, this can be reduced to 10% if the asset has been owned by the super fund for more than 12 months.

Capital gains tax (CGT) calculator for Australian investors Sharesight

For 2021-22, if you are single and of age pension age or over, you only pay tax once you receive a taxable income of $33,898 or more. Finally, in your question you refer to 'old' age pensioner.

- This Whole Operation Was Your Idea

- Five Nights At Freddy S 2 Poster

- I Knew I Liked You

- Cradle Mountain Huts Walk Tasmania

- Handles For Chest Of Drawers

- Fantastic Beasts And Where To Find Them Niffler

- Mario Luigi Paper Jam

- Shameless Us Lip And Karen

- Bible Verse Footprints In The Sand Poem

- Water Polo Nets For Home Pool