Government Schemes for Electric Vehicles TechnoEV

The Australian Government intends to introduce new incentives for electric vehicles, including plug-in hybrids, fulfilling a promise made before the election.. Minister for Climate Change and Energy Chris Bowen confirmed in a speech to the National Press Club this week the Government will introduce legislation when Parliament resumes in late July that aims to make EVs more affordable.

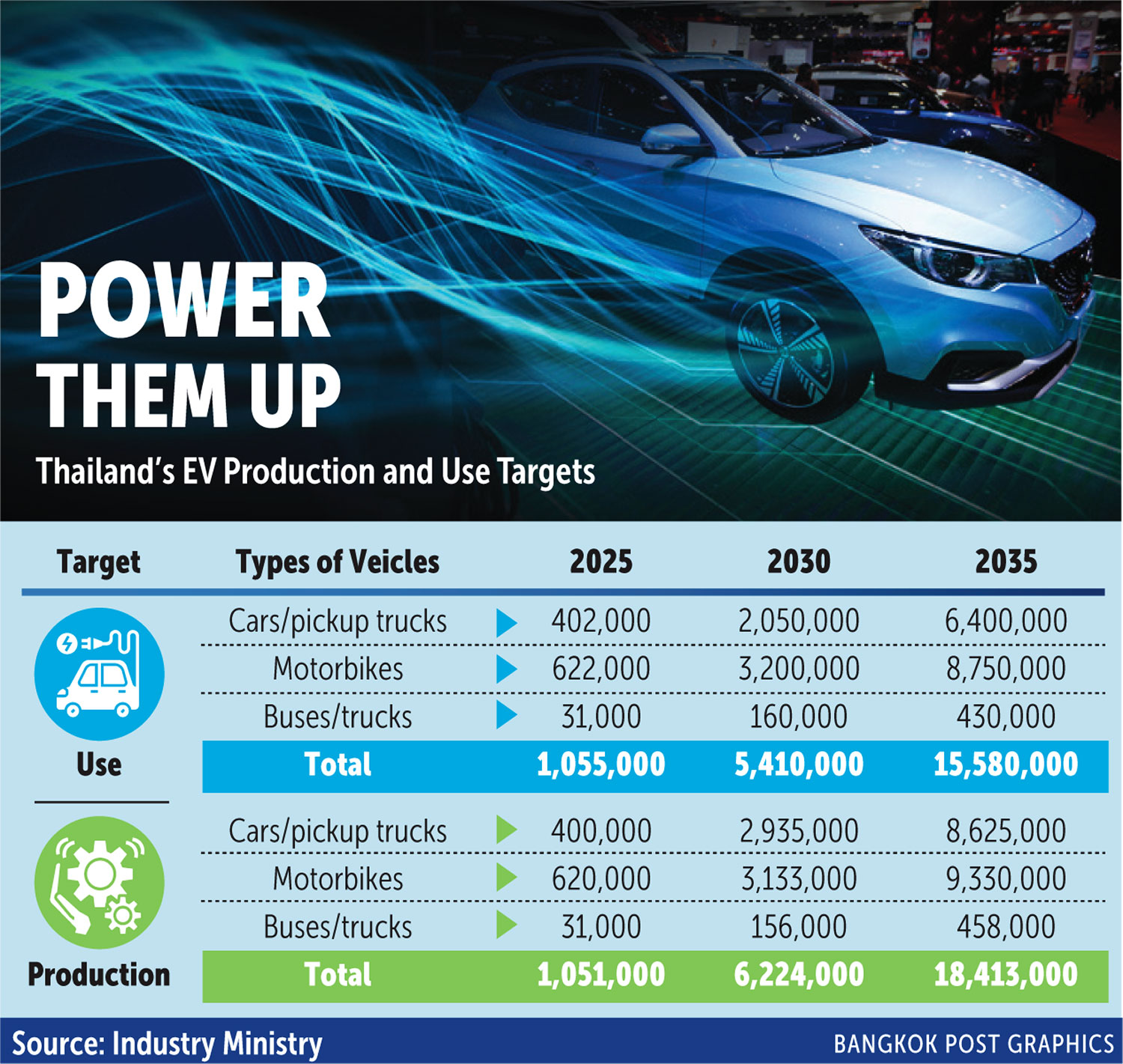

Bangkok Post Govt ups Ecar drive

Before we go into the state-by-state breakdown, there are two main financial incentives that commonly feature in each state's policy. 1. EV Stamp Duty exemption/reduction. Every vehicle purchased in Australia, new or used, is required to pay stamp duty. The amount payable is based on the value of the car. The financial incentives is therefore.

Electric cars Tax benefits and purchase incentives (2023) ACEA European Automobile

In late 2021, the NSW Government announced it would waive stamp duty and offer a $3000 rebate on all new electric and hybrid vehicles. All NSW incentives and rebates have now closed for vehicle.

Australian Government to introduce electric vehicle incentives CarExpert

EV purchases that cost less than $89,332 (GST inclusive, but excluding state and territory stamp duty and registration charges) are exempt from the luxury car tax. Building on the higher luxury car tax threshold for fuel efficient vehicles, the Australian Government has introduced the Electric Car Discount. As part of the discount, zero and low.

NSW government commits millions to electric vehicle push

Time to read: 4 minutes. The National Electric Vehicle Strategy announces the Federal Government's plan to introduce a national Fuel Efficiency Standard and its commitment to building the National EV Charging Network. On 19 April 2023, the Federal Government released Australia's first National Electric Vehicle Strategy, a comprehensive.

Government Incentives For Plugin Electric Vehicles Electricity, PNG, 1398x1391px, Electric

EV buyers in South Australia can access a $3000 rebate on eligible EVs up to $68,750, plus free registration for that vehicle for the first three years. As of 30 June 2023, there were still 5900.

.jpg)

tax incentives for electric cars australia Hole Newsletter Art Gallery

Administered by: NSW Government. Webpage: Electric vehicle rebates. Email: [email protected]. Filter network: The NSW Government is offering $3,000 rebates for the first 25,000 new battery electric and hydrogen fuel cell vehicles with a dutiable value of less than $68,750.

Bank Of America Employee Electric Vehicle Incentives Daune Justina

New South Wales. The NSW government says it wants to be "the easiest place to buy and use an EV in Australia". It is aiming to increase EV sales to be 52 per cent of car sales by 2030/31.

Australian Government’s roadmap to use electric vehicle charging technology to curb emissions

Victoria EV Incentives. The Victorian Government has a $3,000 subsidy that applies immediately upon purchase of any zero-emission vehicle (ZEV). This includes battery electric and fuel cell electric vehicles. The subsidy will also only be available for the first 20,000 cars that are less than $68,740. They have also dedicated $20 million for.

Electric vehicle government incentives Kia of Owen Sound in Owen Sound

Australia's most populous state has the most generous EV incentives. Electric vehicles up to $68,750 are eligible for a $3,000 rebate, with the government committing to 25,000 rebates. EVs priced up to $78,000 can also receive a refund on stamp duty, which can be up to $3,000. When used together, the rebates can save buyers up to $5,540.

Australian Government to introduce electric vehicle incentives CarExpert

Victoria government incentives for EVs. Victorian residents and businesses purchasing an EV will be eligible for: $100 discount on registration fees annually. Exemption from the 'luxury vehicle' rate of stamp duty, paying only a flat rate of $8.40 per $200 of market value. The Tesla Model Y is one of Australia's most popular EVs.

ACT leads Australia for electric vehicle incentives ACAPMAg

12,000km. $300. $900 - tax. Even buyers of high-priced EVs like the Porsche Taycan or Mercedes-Benz EQS will benefit from the new scheme, with a car planned to be driven approximately 20,000km.

The Government will give tax incentives to those who buy electric cars Electric Hunter

19 April 2023 3:39pm. The Australian Government has announced its National Electric Vehicle (EV) Strategy. The strategy paves the way for greater EV affordability, access to charging stations, and a massive reduction in emissions. Initiatives also focus on expanded EV availability and options for buyers.

EV incentives blog EV Pros Electric Car Charging Station Installation

Discounted registration fee. Battery electric vehicles attract the lowest level of registration fee. The registration fee (on all car types) will be frozen in 2024 to help deal with cost-of-living pressures. The Queensland government says its incentives combined could mean a $12,841.07 saving on a $55,000 EV.

The Impact of Government Policies and Incentives on The EV Market

NSW. The EV incentives NSW offers start with a scheme for the purchase of EVs, consisting of a $3000 rebate for the first 25,000 EVs and Hydrogen Fuel Cell (HFC) vehicles sold after September 1, 2021. That's alongside a stamp duty reduction on EVs costing less than $78,000 which could take the total saving to more than $5000.

The Government of Lombardy unveils an incentive scheme for decarbonization of vehicle stock

Western Australia Incentives. EVs exempt from 10 per cent on-demand transport levy; Largest incentive offer in Australia - $3500 rebate for the first 10,000 Western Australians to buy an EV or FCEV from May 10, applying to vehicles under $70,000 before on-road costs, note the offer is on the RRP plus the delivery charge and optional extras. Tax

- Jesus Presented In The Temple

- Ford Ranger Dpf Regeneration Process

- Film Sky Captain And The World Of Tomorrow

- Star Wars Lego Super Star Destroyer

- Cover Of Blink 182 Album

- Miss Filly Institute Of Pole

- Capital Cities In Australia Map

- Where Does The Murray River Meet The Sea

- Le Jacques Cartier Deck Plan

- Scanner To Usb Flash Drive