State Revenue Office

The Queensland Office of State Revenue (Qld OSR) has announced a new approach to its payroll tax compliance programme that may impact many employers with employees based in Queensland. The Qld OSR has advised that employers have until 31 January 2020 to review their Queensland payroll tax lodgments and where needed, revise their returns for any.

Revenue Department Turks and Caicos Islands

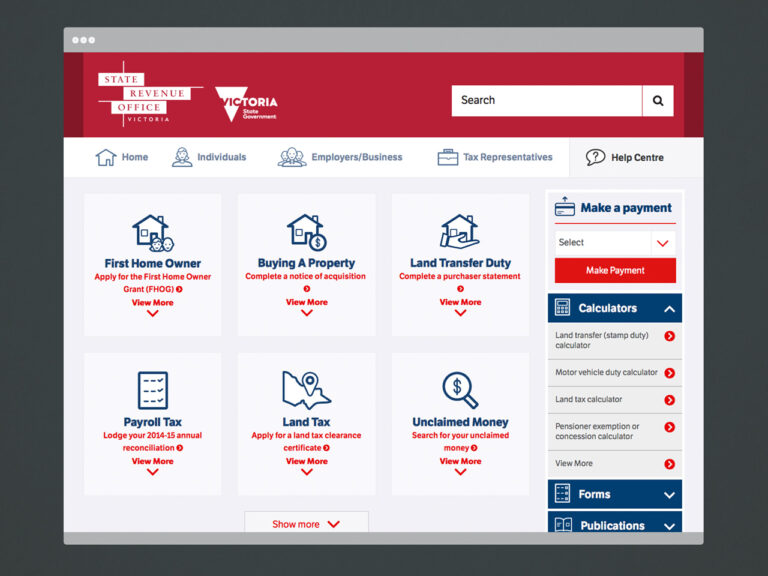

Land tax home exemption eligibility tester. Tools and calculators. Forms. Land tax is an annual tax on land you own in Queensland on 30 June. Different rates apply depending on owner type. There are some exemptions.

Office Of State Revenue Calculator Qld REVNEUS

The Office of State Revenue has changed its name to Queensland Revenue Office (QRO) as of yesterday, 2 December. A QRO spokesman said the change followed feedback from clients and stakeholders, many of whom operated across multiple Australian jurisdictions. The new name made it easier to distinguish QRO as the central authority for revenue.

State Revenue Office Casey Partners Accountants & Business Advisers

Queensland Government | Online tax portal

MailGuard Breaking IT News Fake NSW Office of State Revenue Scam

In November 2021 the Office of State Revenue changed its name to , Queensland Revenue Office. Feedback from clients who operate in multiple jurisdictions found that it was difficult to distinguish between revenue offices. The new name is in line with a growing number of other jurisdictions who also feature their state/territory name in their.

Land tax when to contact the Office of State Revenue YouTube

Commissioner of Queensland Revenue Office and Registrar of the State Penalties Enforcement Registry Simon was appointed Commissioner and Registrar in August 2023. He has extensive strategic leadership experience in the public sector, including in Treasury and revenue offices, and leading large-scale operational and technical functions.

Florida Department of Revenue Customer Service, Complaints and Reviews

Queensland Revenue Office delivers simple, efficient and equitable management of state taxes and royalties. We strive to make compliance effortless for taxpayers across duties, payroll tax, land tax, betting tax and mining and petroleum royalties. We also collect and enforce fines and penalty debt through the State Penalties Enforcement.

(PDF) SRS Catalog Standards version 2.5 State Revenue Society DOKUMEN.TIPS

In 2021, the former Office of State Revenue (OSR) merged with the State Penalties Enforcement Registry (SPER) to become the QRO of today. The revenue we collect provides $35 billion in income for Queensland. We put this money back into roads, schools, hospitals and health services, as well as art galleries and community events.

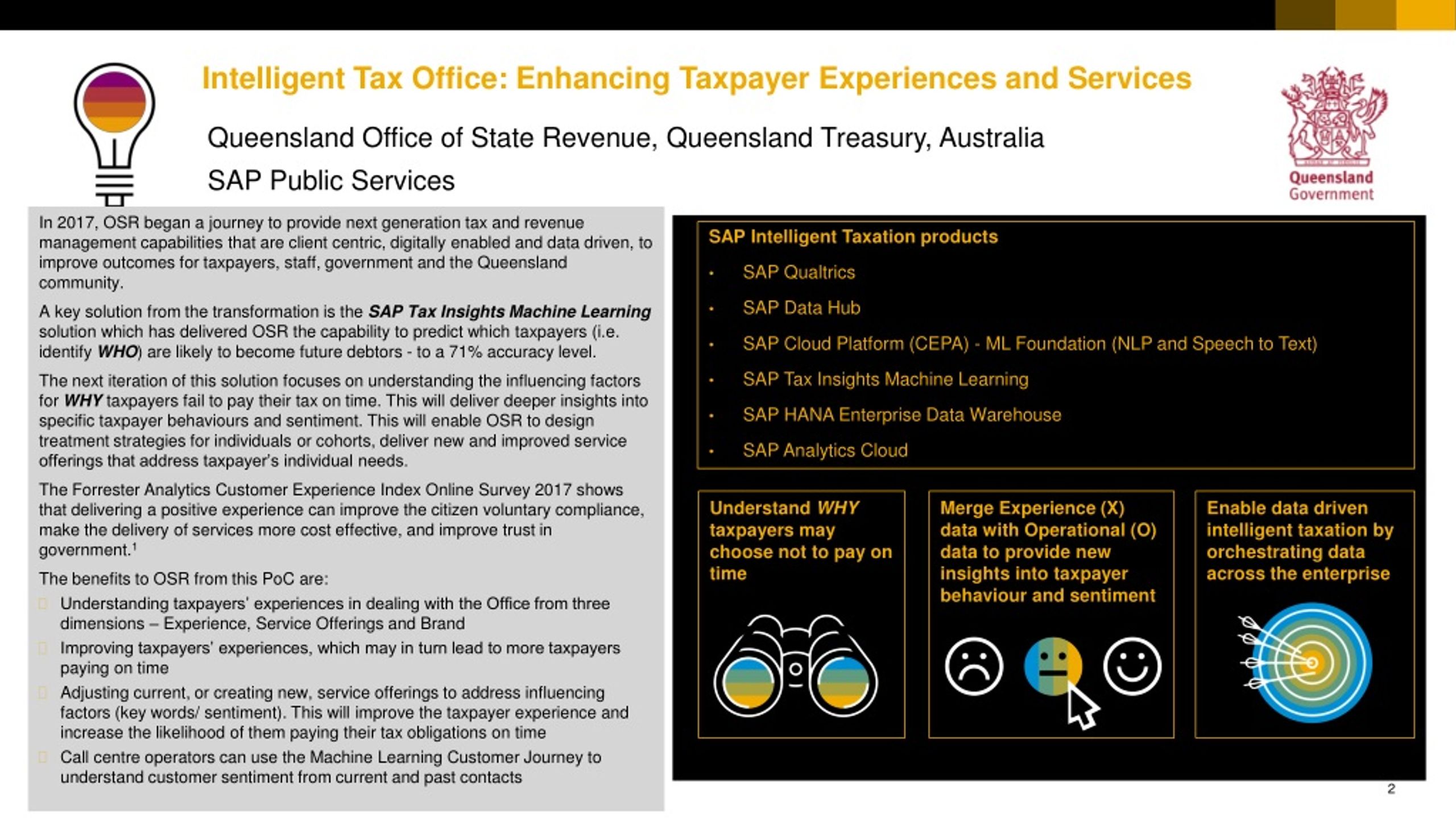

PPT Office of State Revenue, Queensland Treasury, Australia PowerPoint Presentation ID8855451

Queensland Revenue Office. Duties, payroll tax, betting tax, land tax, royalties, home owner grants. GPO Box 15931 CITY EAST QLD 4002 Phone: (in Australia) 1300 300 734 Overseas: +61 7 3013 4510 Web: www.qro.qld.gov.au. See more contact details for Queensland Revenue Office. State Penalties Enforcement Registry (SPER) GPO Box 1387 BRISBANE QLD.

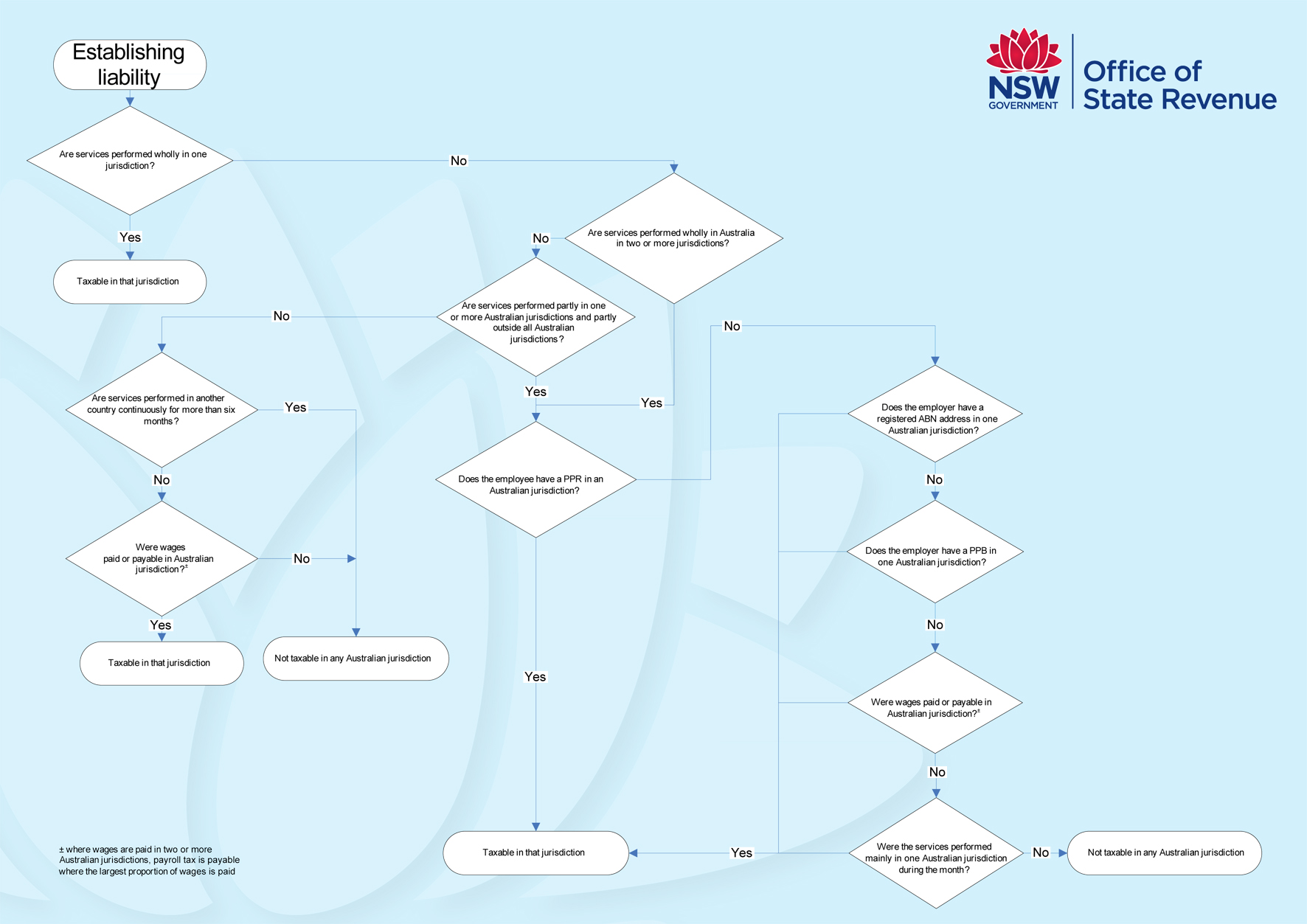

Payroll tax nexus provisions Revenue NSW

2010 Abidjan Pl Washington DC 20521-2010 6010 Abu Dhabi Pl Washington DC 20521-6010 8320 Abuja Pl Washington DC 20521-8320 2020 Accra Pl Washington DC 20521-2020 5020 Adana Pl Washington DC 20521-5020 2030 Addis Ababa Pl Washington DC 20521-2030 2035 USAU Pl Washington DC 20521-2035 4170 AIT Taipei Pl Washington DC 20521-4170 6030 Algiers Pl Washington […]

Office of State Revenue PSA Victory Public Service Association

Essentials Payments Find the different ways you can pay your liability, fine or debt.; Unpaid tax interest and penalties Find out about how interest and penalties apply to late lodgements and payments.; Complaints and objections Read about our process for handling complaints.; Public rulings and practice directions Browse our library of public rulings and practice directions.

State Revenue Catalog · State Revenue Society

The 2022-23 Report on State Finances incorporates both the Outcomes Report prepared on a Uniform Presentation Framework (UPF) basis and the AASB1049 Financial Statements prepared in accordance with Australian Accounting Standards, providing a comprehensive view of the financial operations and position of the Queensland Government. 26 October 2023.

Queensland Land Tax & Absentee Surcharge victims

Registering for payroll tax. As an employer, you must register for payroll tax within 7 days after the end of the month in which you: pay more than $25,000 a week in Australian taxable wages. or. become a member of a group that together pays more than $25,000 a week in Australian taxable wages. Read about how to register.

State Revenue Office Victoria 18th Annual Australian Web Awards

Payroll tax. Payroll tax is a self-assessed tax on the wages that employers pay to their Queensland employees when the total wages are more than a certain threshold. Log in to QRO Online.

Fillable Online Document Lodgement Form Form TR1Office Of State Revenue Qld Fax Email Print

Acting Treasurer John McVeigh today announced Elizabeth Goli had been named as the new Commissioner for the Office of State Revenue (OSR). "Ms Goli's extensive taxation background and leadership experience at both the Queensland OSR and the Australian Tax Office mean she is perfectly placed to continue the Newman Government's methodical.

State Revenue Office Updates Audio Visual System Vision One

Get help with QRO Online. Find out how to set up and use QRO Online to lodge forms for state taxes, royalty and duties. Check your balance, make payments and keep your details up to date. Log in to QRO Online.