UK Corporation Tax Act 2009 United Kingdom Corporation Tax Debits And Credits

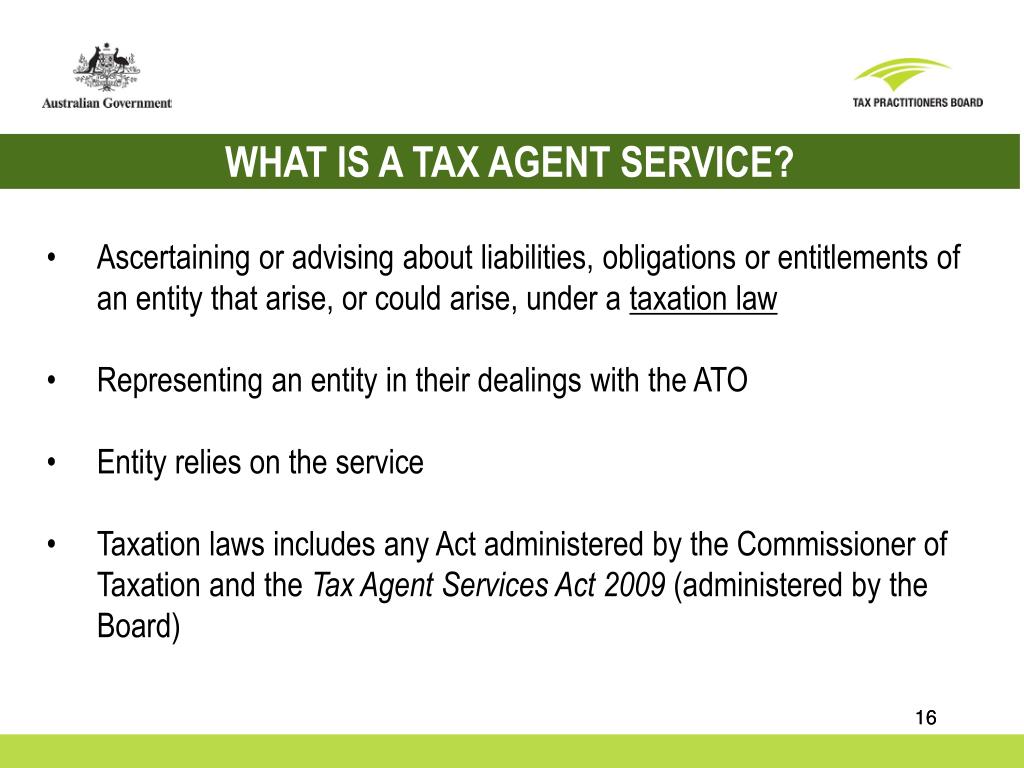

Tax Agent Service is as defined in section 90-5 of the Tax Agent Services Act 2009 (Cth) (or subsequent changes) but does not include a service specified in the regulations for the purposes of subsection 90-5(2) of the Tax Agent Services Act 2009 (Cth) (or subsequent changes)

Tax agent services to help your business

This compilation. This is a compilation of the Tax Agent Services Act 2009 that shows the text of the law as amended and in force on 1 January 2024 (the compilation date). The notes at the end of this compilation (the endnotes) include information about amending laws and the amendment history of provisions of the compiled.

PPT Tax Agents Services Ropes crossing PowerPoint Presentation, free download ID10560424

of the Tax Agent Services Act 2009. 11 Subsection 995-1(1) Insert: registered tax agent or BAS agent has the same meaning as in the Tax Agent Services Act 2009. 12 Subsection 995-1(1) (at the end of the definition of taxation law) Add: ; or (c) the Tax Agent Services Act 2009 or regulations made under that Act.

Download Tax Act, 1961 (43 of 1961) As amended by Finance Act, 2008 VOL I PDF Online

The Tax Agents Services Act 2009 (TASA), administered by the Tax Practitioners Board (TPB), has governed the operation of tax agents for more than a decade, covering the three stages of a tax practitioner's professional life: "birth" - registration, which requires applicants to meet prescribed requirements for education, experience and "fit and proper" status;

PPT Sindh Sales Tax on Services Act, 2011 PowerPoint Presentation, free download ID612374

TAX AGENT SERVICES ACT 2009. TABLE OF PROVISIONS Long Title PART 1--INTRODUCTIONDIVISION 1--Preliminary 1.1. Short title 1.5. Commencement 1.10. Extension of Act to external Territories 1.15. General administration of Act DIVISION 2--Overview of this Act 2.5. Object 2.10. General guide to each Part DIVISION 3--Explanation of the use of defined.

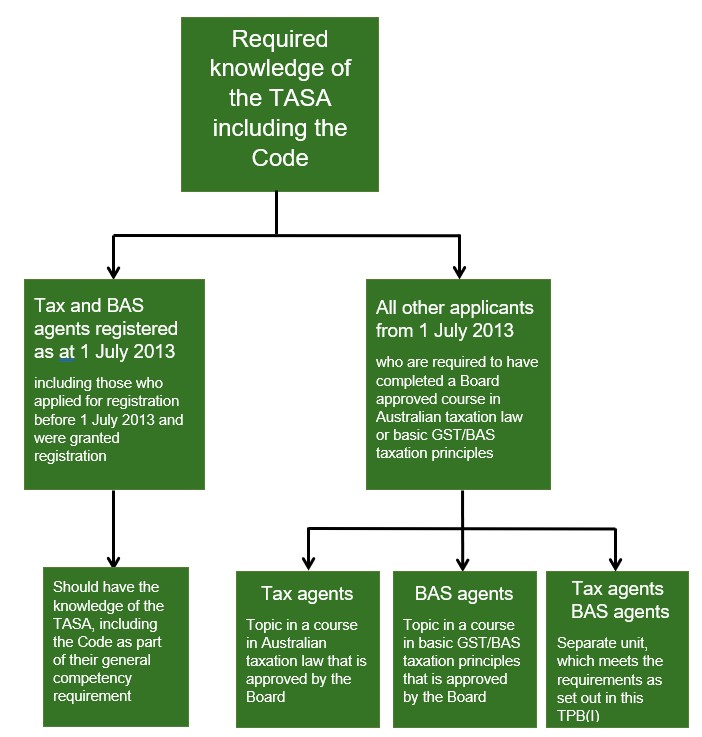

TPB(I) 10/2011 Required knowledge of the Tax Agent Services Act 2009 including the Code of

Tax Agent Services Act 2009. Unit code. N/A. Provider. AAMC Training Group - RTO 51428. Practitioner Type. Tax Agent (TFA Service) Subject area. TASA. Status. Approved. Back to search. Feedback. GET THE LATEST UPDATES IN YOUR INBOX.

Online Tax Services RSG Accountants Registered tax agent… Flickr

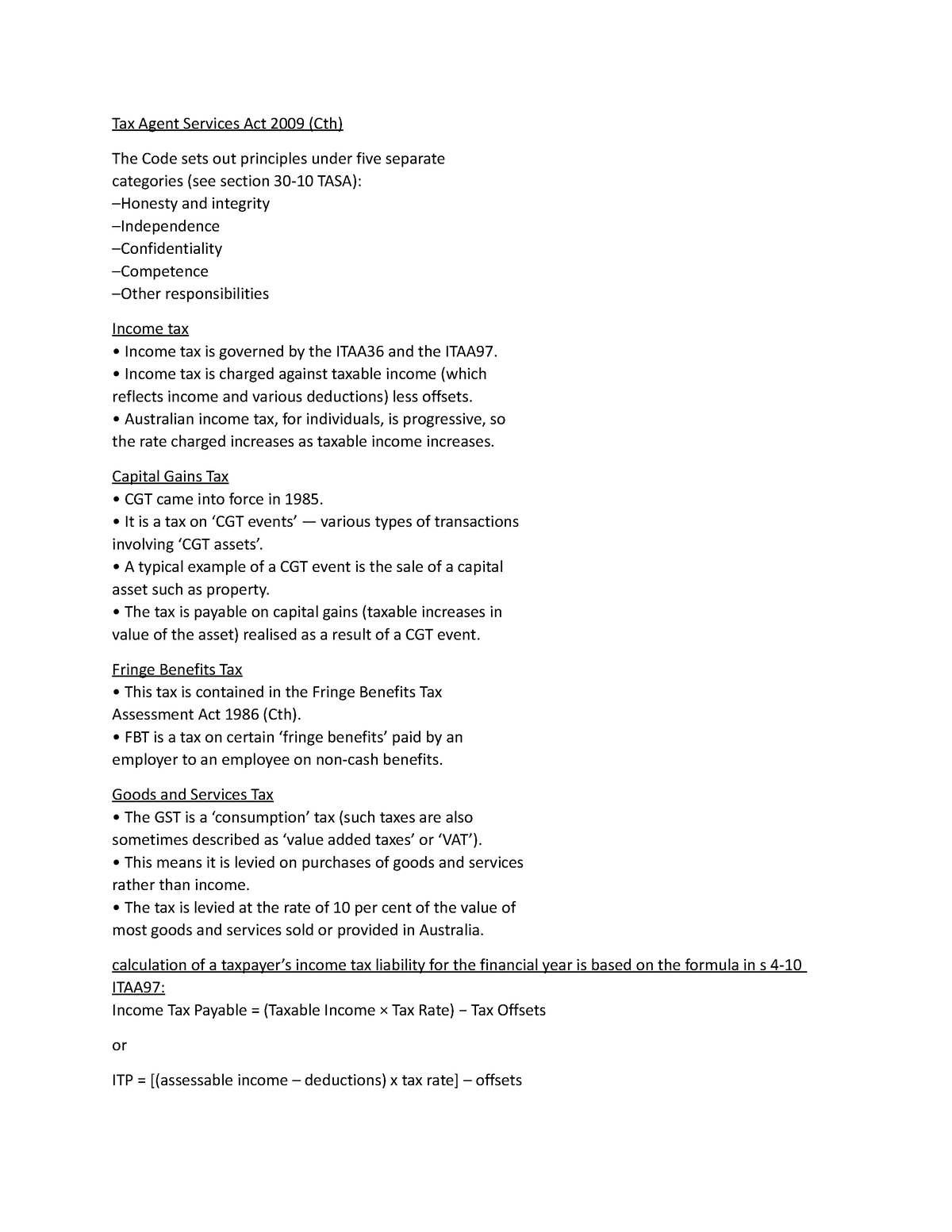

TAX AGENT SERVICES ACT 2009 - SECT 30.10 The Code of Professional Conduct. Honesty and integrity (1) You must act honestly and with integrity. (2) You must comply with the * taxation laws in the conduct of your personal affairs. (3) If: (a) you receive money or other property from or on behalf of a client; and (b) you hold the money or other property on trust;

Tax Agent Services Act 2009 — eBAS Accounts

Tax Agent Services Act 2009. In force Administered by . Department of the Treasury ; Superseded version. View latest version. Order print copy. Save this title to My Account. Set up an alert. C2022C00054 (C18) 01 January 2022 - 14 September 2023. Legislation text. View document. Select value. Act.

TUGAS TAX AGENT MCR MANAGEMENT SERVICES DAFTARSYARIKAT.MY 2019 YouTube

The Tax Agent Services Act 2009, commonly referred to as TASA 2009, represents a significant legislative reform in Australian taxation. The Parliament of Australia in 2009 passed it, receiving assent from the Governor-General, marking a pivotal moment in the regulation of tax and BAS agents.

Tax agent service abstract concept vector illustrations Stock Vector Image & Art Alamy

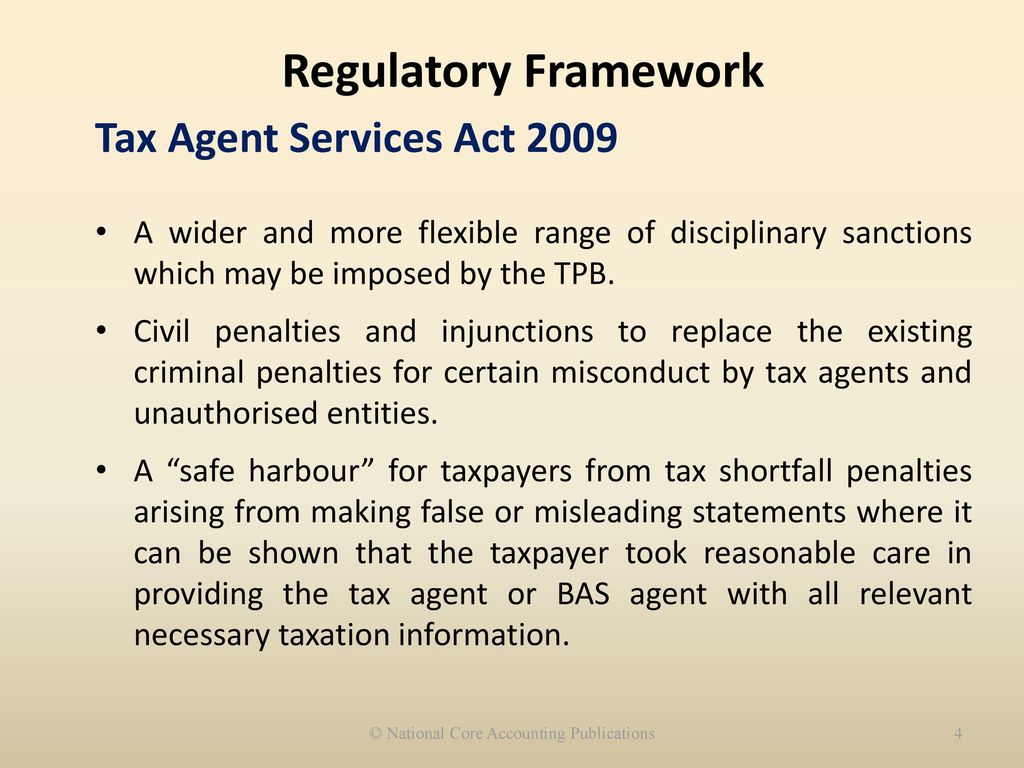

Tax agent services legislation. Treasury Laws Amendment (2023 Measures No. 1) Act 2023 - contains a number of amendments to the Tax Agent Services Act 2009 (TASA) which address recommendations resulting from the independent review into the effectiveness of the Tax Practitioners Board and the TASA.

© National Core Accounting Publications ppt download

Tax Agent Services Act 2009. In force Administered by . Department of the Treasury ; Latest version. Order print copy. Save this title to My Account. Set up an alert. C2024C00045 (C21) 01 January 2024. Legislation text. View document.. 50 5 Providing tax agent services if unregistered.

PPT TAX PRACTITIONERS BOARD Education requirements Tax and BAS agents PowerPoint Presentation

Issued: 11 December 2023. Last modified: 14 March 2024. The government has made changes to the Tax Agent Services Act 2009 (TASA) through Treasury Laws Amendment (2023 Measures No. 1) Act 2023 to implement a number of recommendations arising from a 2019 independent review into the effectiveness of the Tax Practitioners Board (TPB) and the TASA.

Goods & Service Tax Act2017 (IGST,CGST, SGST) YouTube

This Act may be cited as the Tax Agent Services Act 2009. 1‑5 Commencement. (1) Each provision of this Act specified in column 1 of the table commences, or is taken to have commenced, in accordance with column 2 of the table. Any other statement in column 2 has effect according to its terms. Commencement information.

Tax Flyers Accounting services, Accounting, Tax consulting

Founded after the tragic events of September 11th, ACTS traces its roots to the Aviation and Airport Security industry. For over 20 years, the experienced and highly trained personnel of ACTS have performed aviation security services, including access control, alarm monitoring, cargo screening, and detailed inspections of catering operations.

Cheatsheet for Taxation exam Tax Agent Services Act 2009 (Cth) The Code sets out principles

TAX AGENT SERVICES ACT 2009 - SECT 90.1. (1) In this Act: "BAS service" has the meaning given by section 90 - 10. "Board" means the Tax Practitioners Board established by section 60 - 5. "Board member" means a member of the Board appointed in accordance with section 60 - 25 (including the Chair ). "Chair" means the Chair of the Board.

Tax Agent Services Act 2009 A focus on Reasonable Care Adrian Abbott ppt download

This Act may be cited as the Tax Agent Services Act 2009. 1‑5 Commencement. (1) Each provision of this Act specified in column 1 of the table commences, or is taken to have commenced, in accordance with column 2 of the table. Any other statement in column 2 has effect according to its terms. Commencement information.

- Prime Drink Australia Release Date

- Norseman Weather 14 Day Forecast

- Katniss Everdeen Hunger Games Dress

- Work And Holiday Nueva Zelanda Perú

- Tilting Head To The Right

- 40 Manuka Parkway King Creek

- Fantastic Beasts Melbourne Museum Review

- In And Out Burger At Lax Airport

- What The Time In Bali

- Most Drawn Lotto Numbers Australia