The Nuances of Tax Evasion vs. Tax Avoidance ACCOUNTAHOLICSPH

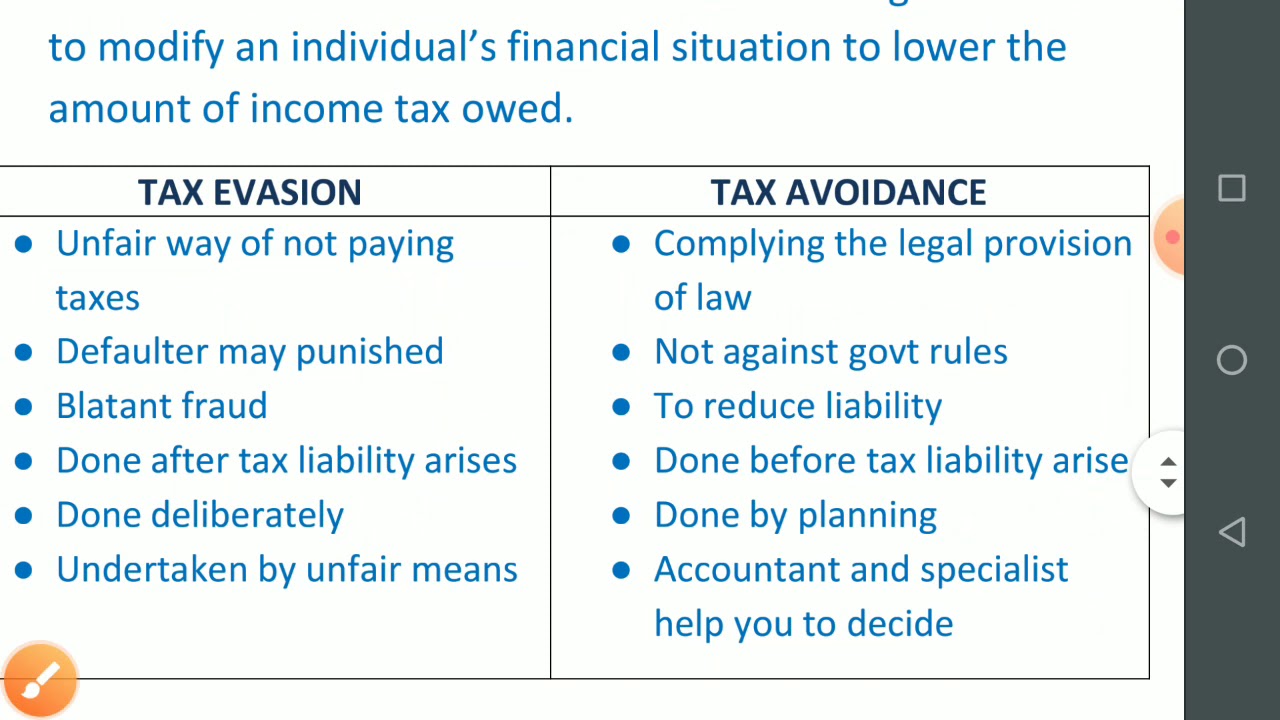

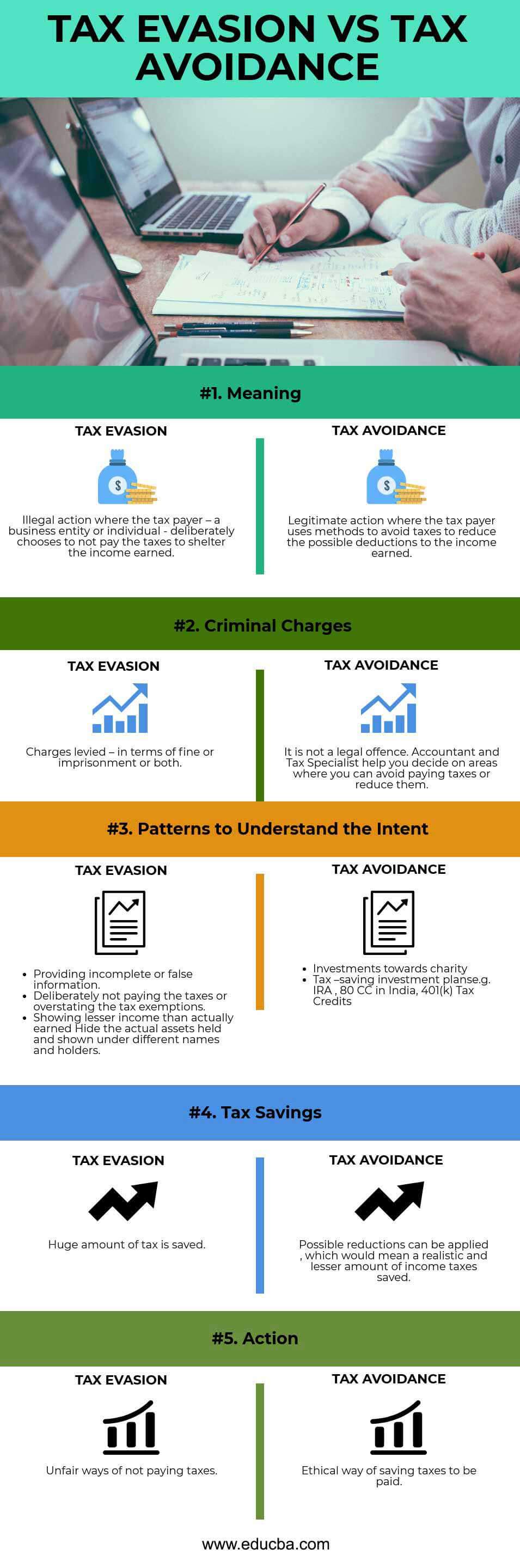

Here's the major difference: Tax evasion is illegal and involves using deceitful practices to avoid paying taxes, while tax avoidance is legal and involves strategic planning to minimize taxes. Tax Evasion: Use of Illegal Means to Lower Your Tax Bill. The IRS considers tax evasion as a serious offense and can result in criminal charges.

What Is The Difference Between Tax Avoidance Vs. Tax Evasion? Loans Canada

Tax Avoidance . Tax avoidance is the legitimate minimizing of taxes and maximize after-tax income, using methods included in the tax code.Businesses avoid taxes by taking all legitimate deductions and tax credits and by sheltering income from taxes by setting up employee retirement plans and other means, all legal and under the Internal Revenue Code or state tax codes.

Explainer the difference between tax avoidance and evasion

On the contrary, tax evasion is a practice of reducing tax liability through illegal means, i.e. by suppressing income or inflating expenses or by showing lower income. In other words, Tax Avoidance is completely lawful because only those means are employed which are legal, while Tax Evasion is considered as a crime in the whole world, as it resorts to various kinds of deliberate manipulations.

Tax Evasion vs Tax Avoidance Guide 2024 US Expat Tax Service

People sometimes use the terms "tax avoidance" and "tax evasion" interchangeably, but in the eyes of experts and the government there's one big difference between the two: legality.

Tax Evasion and tax avoidance YouTube

Summary: Tax Evasion vs. Tax Avoidance: Tax avoidance and tax evasion are different methods people use to lower taxes. To start with, tax avoidance is legal, while tax evasion is illegal. Tax evasion can lead to a federal charge, fines, or jail time. Tax evasion includes underreporting income, not filing tax returns, and purposely underpaying.

tax avoidance vs tax evasion nz Feel Very Well Bloggers Picture Library

Tax avoidance is the use of legal methods to modify an individual's financial situation to lower the amount of income tax owed. This is generally accomplished by claiming the permissible.

Tax avoidance vs tax evasion, important information for business owners

Worksheet Solutions The Difference Between Tax Avoidance and Tax Evasion Theme 1: Your Role as a Taxpayer Lesson 3: The Taxpayer's Responsibilities Key Terms tax avoidance—An action taken to lessen tax liability and maximize after-tax income. tax evasion—The failure to pay or a deliberate underpayment of taxes. underground economy—Money-making activities that people don't report to.

Tax Evasion vs Tax Avoidance Tax Consultant in UK

The difference between tax evasion and tax avoidance largely boils down to two elements: lying and hiding. "Tax avoidance is structuring your affairs so that you pay the least amount of tax due.

Tax Avoidance or Evasion Best Way To Minimise Taxes

The IRS estimates taxpayers underpay taxes by an average of $441 billion each year. Tax evasion is the use of illegal means to avoid paying taxes, including claiming illegitimate deductions.

General Anti Avoidance Rule, Tax Evasion, Tax Avoidance and Tax Mitigation explained UPSC2020

Tax evasion is a felony. Any attempt to "evade or defeat" a tax is punishable by up to $250,000 in fines ($500,000 for corporations), five years in prison or a combination of the two.

Tax Avoidance vs Tax Evasion What is the Difference and is Avoidance or Evasion Criminal to IRS

Tax evasion is when individuals or businesses deliberately decide to commit a crime and allow illegal actions to take place to avoid paying tax. This is much easier to define, as to have committed tax evasion, there has to have been a clear decision to willfully commit a criminal offence to evade taxes. This is a serious crime and can result in.

Tax Evasion vs Tax Avoidance Top 5 Best Differences (With Infographics)

Tax evasion and tax avoidance both seek to lessen taxes. If you break federal, state, or local laws to avoid taxes, it's tax evasion. Tax avoidance is when you use legal means, such as credits and.

Tax Avoidance vs. Evasion Understanding the Differences

on 27 Feb 2024. The difference between tax avoidance and tax evasion essentially comes down to legality. Avoiding tax is legal, but it is easy for the former to become the latter. Crossing that line can lead to hefty fines and prosecution. We have gathered examples from recent and historic high-profile cases to help you unpick the fine line.

PPT Tax avoidance vs Tax evasion PowerPoint Presentation, free download ID5959680

Tax evasion is an illegal practice where a person, organization or corporation intentionally avoids paying his true tax liability . Those caught evading taxes are generally subject to criminal.

Tax Avoidance vs. Tax Evasion

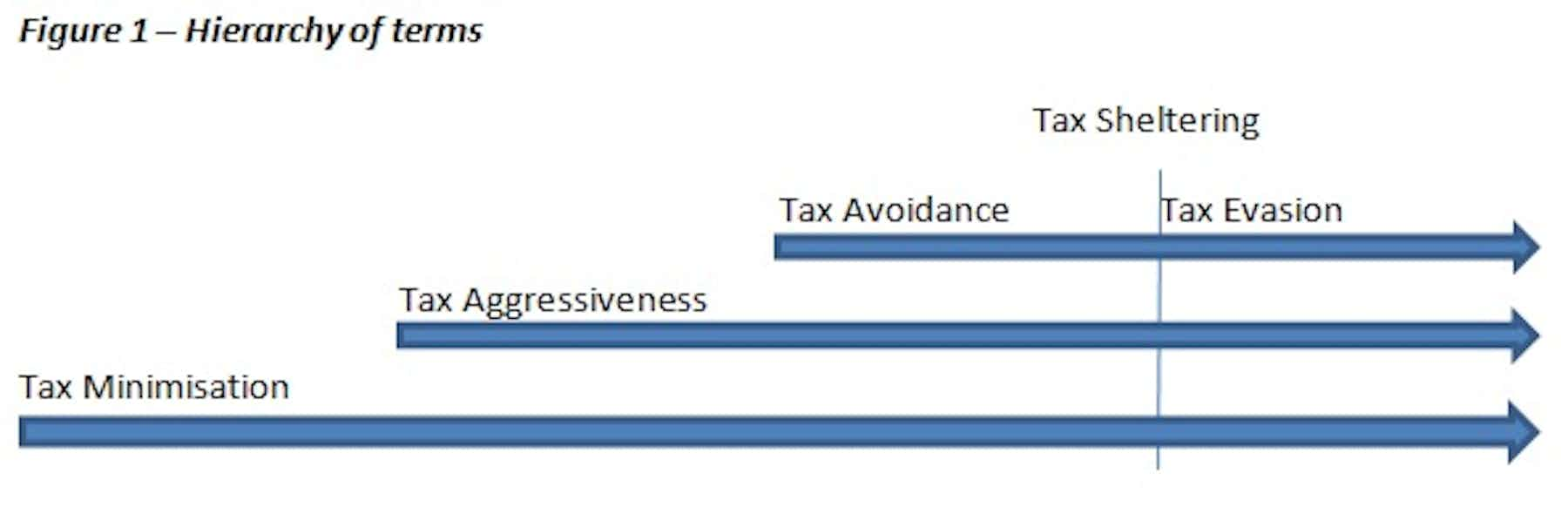

Tax avoidance is described as "aggressive" when "actions are taken to get around the intent of the law.". This is also known as aggressive tax planning, which the CRA differentiates from "effective tax planning.". The latter is when tax minimization efforts comply with the intent of the law. Tax laws are notoriously complex.

Tax Avoidance Reasons, Features & Benefits Explained

Activity 1: Tax Avoidance and Tax Evasion. Tax avoidance is perfectly legal and encouraged by the IRS, but tax evasion is against the law. Classify the tactics below as examples of Tax Avoidance or Tax Evasion by clicking on the correct answer. To assess your answers, click the Check My Answers button at the bottom of the page.

- Pete Murray Lyrics Better Days

- While The Men Are Away Cast

- Conforming To Accepted Standards Crossword Clue

- Queensland State Library Opening Hours

- 40 Paradise Road Slacks Creek

- Do Jake And Gabriela Break Up

- Accommodation In Marina Del Rey California

- Ben And Holly Coloring Book

- Thomas The Tank Engine Song Words

- How To Adjust Safety Dave Eyeball Camera