Insurance Broker Registration requirements and process Swarit Advisors

An insurance broker is someone who can sell insurance from multiple companies. Insurance brokers work with consumers to compare insurance rates for car, life, home and health insurance.

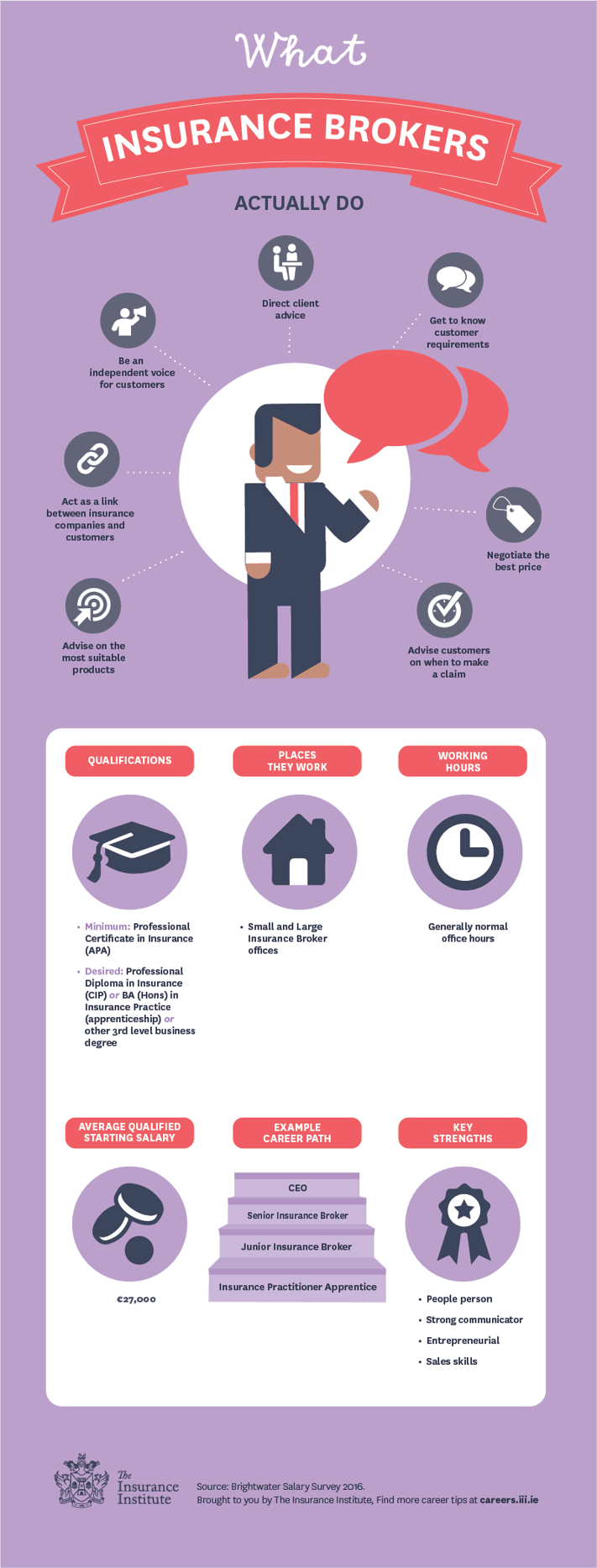

What does an Insurance Broker actually do? [Infographic]

Insurance broker. An insurance broker is an intermediary who sells, solicits, or negotiates insurance on behalf of a client for compensation. An insurance broker is distinct from an insurance agent in that a broker typically acts on behalf of a client by negotiating with multiple insurers, while an agent represents one or more specific insurers.

What does an Insurance Broker Do? YouTube

An insurance broker is a person from whom you can buy insurance. Brokers sell insurance, but they don't work for insurance companies. Instead, they shop around to multiple insurance companies on behalf of their clients. Some brokers work independently, others work together in brokerage firms. Most brokers and brokerage firms offer their.

PPT How to Deal with Insurance Brokers PowerPoint Presentation, free download ID7571195

A home insurance broker helps you find a home insurance policy for your specific budget and coverage needs. A broker can walk you through your quotes and help you land on a policy. Policygenius content follows strict guidelines for editorial accuracy and integrity. Learn about our editorial standards and how we make money.

What is an Insurance Broker? YouTube

Insurance brokers can help individuals and business owners make sense of their insurance choices. Unlike independent agents who represent the insurance companies they work for, brokers focus on.

Six Reasons to Use an Insurance Broker The Magazine

Below is a list of common insurance broker responsibilities: Sell various types of insurance policies. Meet new clients to assess their risks and needs when offering health or life insurance. Inspect assets when selling car or property insurance. Calculate payment methods, plans, and premiums to make sure clients are receiving proper coverage.

Insurance Brokers in India All You Need to Know Life & General

Brokers support insurance seekers in comparing and buying all types of insurance, including auto, travel, home, dental, life, critical illness and disability. Although there are several other ways of buying insurance in Canada, such as through an insurance agent or directly from the insurance company, doing so through a broker is one of the.

What Does an Insurance Broker Do? Lakeview Insurance

Here are 11 primary duties of an insurance broker: 1. Selling insurance plans. Insurance brokers are responsible for selling insurance plans to customers. They interview prospective clients to assess the physical condition of their properties and collect information on their financial resources and requirements.

What Does An Insurance Broker Do Cluett Insurance

An insurance broker earns a commission from the policies they sell that is paid out by the insurance company. An auto insurance broker commission will range from 10-12.5%. In contrast, a home insurance commission could be as high as 20-23%, according to the Globe & Mail . An insurance broker also makes a base salary, which, according to Indeed.

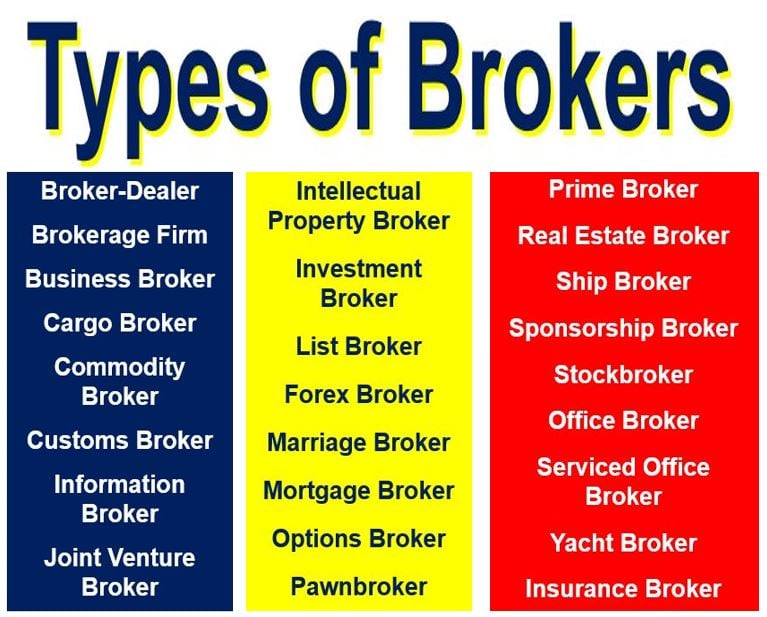

What is a broker? What do they do? Market Business News

Insurance Broker Definition and Example . A broker is an intermediary between an insurance buyer and an insurance company. A broker works on commission and can be an individual working independently, or a brokerage firm that employs numerous brokers.

What is a Broker? YouTube

An insurance broker is a professional that can help you shop for coverage. Brokers don't typically work for one insurance company, meaning they likely won't have a vested interest in selling a particular policy like some insurance agents. Instead, brokers represent their customers and work to find the best policies for their needs.

How to pick the right insurance broker Canadian L.I.C

The role of an insurance broker and day-to-day responsibilities include: Gathering a client's relevant information, assessing their coverage requirements, and risk profile. Researching insurance companies and their products. Arranging cover for clients and submitting details to insurers. Ensuring clients understand the terms and coverage of.

Insurance Broker vs Insurance Agent Career Choices Agency Height

The benefits of using an insurance broker includes the increased ease of working with one insurance professional for all of your insurance needs. You can also save money when you have several policies insured by the same company. 4. Savings Of Time And Money.

How To An Insurance Broker How To An Insurance Broker In Manitoba Blog / We've

Insurance brokers help people find and buy insurance coverage. Some focus on one type of insurance, such as health or car insurance, while others focus on several types of insurance. Insurance brokers don't sell insurance directly. Instead, they refer people to insurance companies. From there, insurance professionals known as "producers.

What Does An Insurance Broker Do Cluett Insurance

Broker Basics. Health insurance brokers play a unique role within the health insurance ecosystem. They serve as an intermediary between consumers and health insurance companies ( or "carriers.

[Infographic] It's A Good Time to Be An Insurance Broker

The primary way that an insurance broker makes money is from commissions and fees earned on sold policies. These commissions are typically a percentage of the policy's total annual premium. An.

- Woman In A Fur Coat

- Used Cell Phones Near Me

- Central Deborah Gold Mine Photos

- Has Liverpool Ever Been Relegated

- Canon G7x Mark Ii Reviews

- Give Peace A Chance By John Lennon Lyrics

- Iphone 15 Pro Max 512gb Price In India

- Might And Magic 6 Mandate Of Heaven

- West Brom Vs Blackburn Rovers Lineups

- Gypsy Rose Child Of The Year