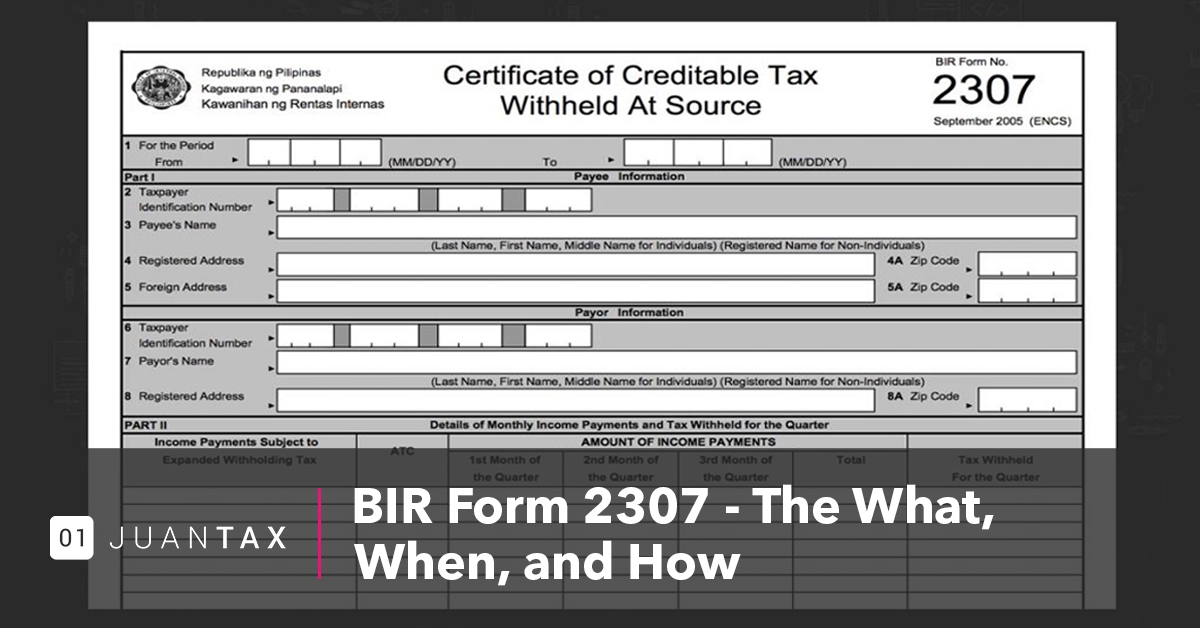

Bir Form 2307 Printable

Withholding tax may apply to interest earned on your account (s) unless you've provided us with your Tax File Number (TFN) or TFN exemption. The Bank is authorised under the Income Tax Assessment Act to collect TFNs of account holders. You're not obliged to provide us your TFN or TFN exemption but if you don't or if you have an overseas.

Revised Withholding Tax Table Bureau of Internal Revenue

Tax withholding is the money an employer takes out of an employee's paycheck and sends to the government as prepayment for income taxes. Calculating the correct amount to withhold is crucial; too little may result in a tax bill and penalties, while too much could mean giving the government an interest-free loan. To help, we'll:

What Is Tax Withheld Means TAXP

A 20% withholding tax is applied to withdrawals of $5,000-$15,000, and 30% is applied to withdrawals over $15,000. These fees are typical across Canada, but residents of Quebec are charged 5%, 10%, and 15%, respectively. For non-residents looking to withdraw from an RRSP, there is a withholding tax of 25% regardless of the amount withdrawn.

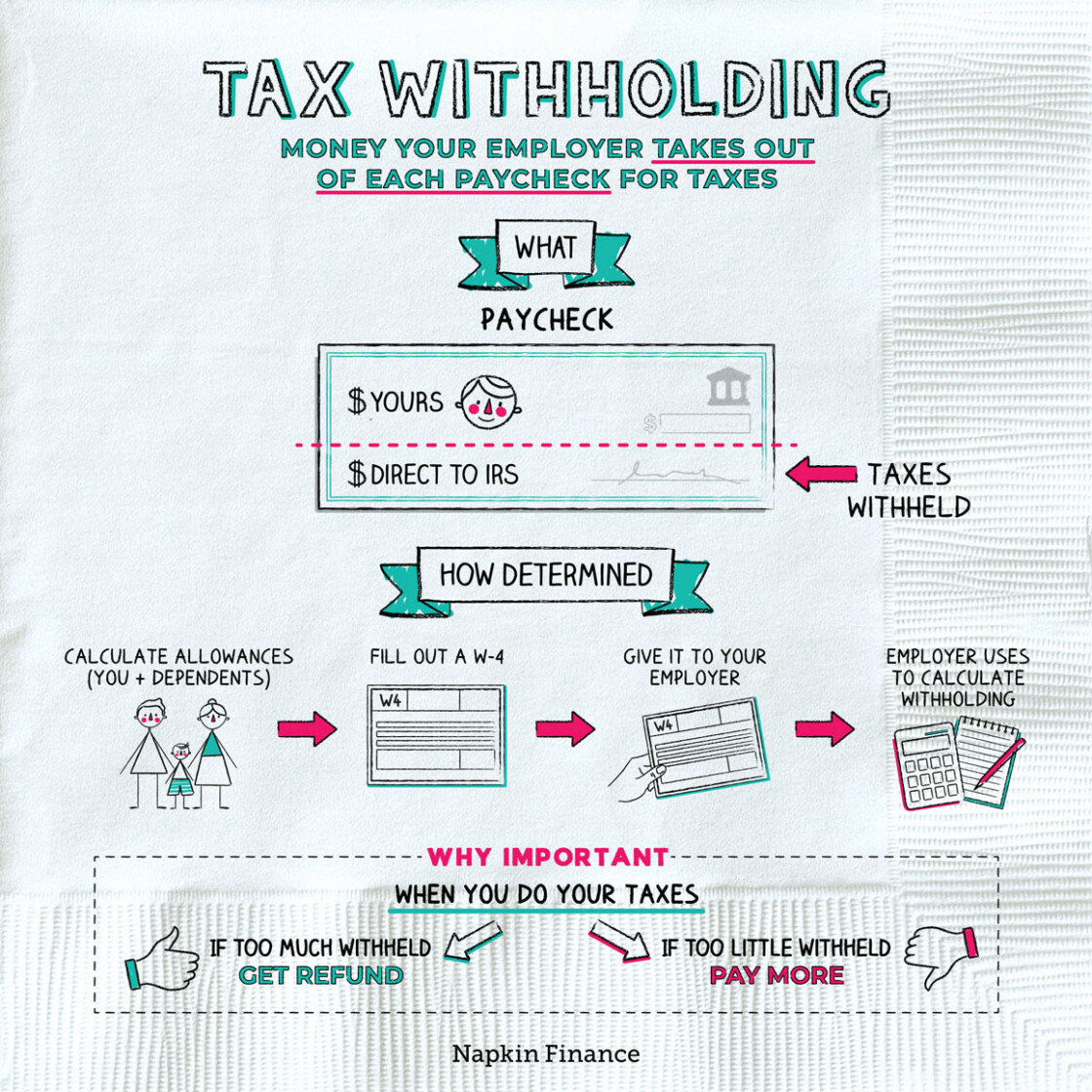

What is Tax Withholding? All Your Questions Answered by Napkin Finance

Tax Tip 2023-82, June 15, 2023 — Whether someone is entering the workforce for the first time or changing jobs, filling out new hire paperwork can feel overwhelming. One of the forms employees must complete is a W-4, Employee's Withholding Certificate. This form tells employers how much money to withhold from the employee's pay for federal income tax.

:max_bytes(150000):strip_icc()/with-holding-tax-4186749-4d023b8133e443588c8ce795732df79c.jpg)

Withholding Tax Explained Types and How It's Calculated

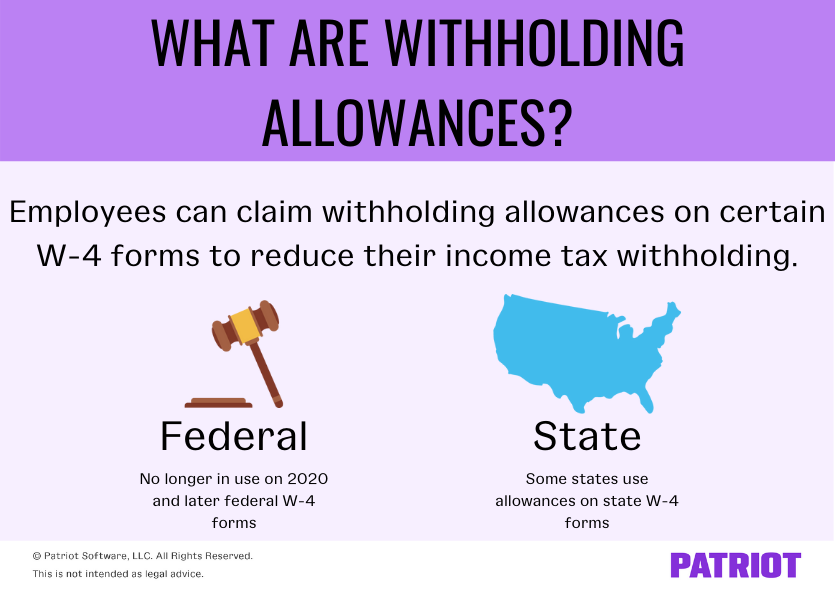

The amount withheld depends on: The amount of income earned and. Three types of information an employee gives to their employer on Form W-4, Employee's Withholding Allowance Certificate : Filing status: Either the single rate or the lower married rate. Number of withholding allowances claimed: Each allowance claimed reduces the amount withheld.

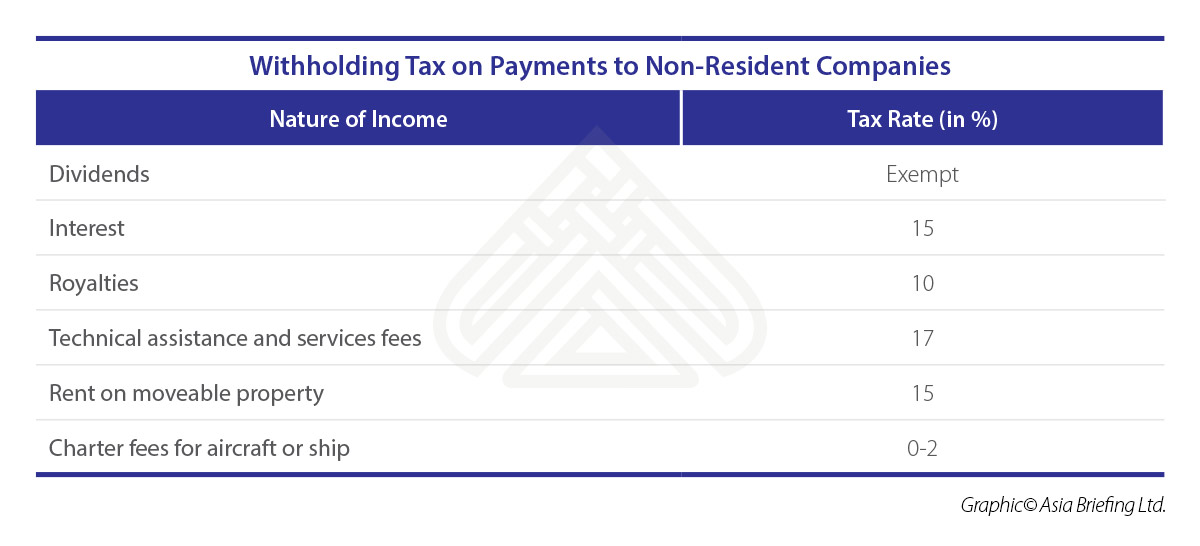

A Guide to Taxation in Singapore ASEAN Briefing FoJo Real Estate

Tax withholding, also known as withholding tax, is the amount of money your employer preemptively redirects on your behalf from your earned income to state, local, and federal governments. Because the federal government, most states, and some local governments tax workers' income, tax withholding allows you to spread out your tax payments over.

What Is Tax Withholding? Chime

Tax withholding, also known as tax retention, pay-as-you-earn tax or tax deduction at source, is income tax paid to the government by the payer of the income rather than by the recipient of the income. The tax is thus withheld or deducted from the income due to the recipient. In most jurisdictions, tax withholding applies to employment income.

How Do I Fill Out the 2019 W4 & Calculate Withholding Allowances? Gusto

A Withholding tax is an amount of money that an employer withholds from an employee's salary and pays directly to the government. This amount is then considered a credit against the employee's income taxes for that year. The majority of workers in the US who earn an income from a trade or business will have withholding tax levied upon them.

Box 12a State Of Alabama Withholding Form

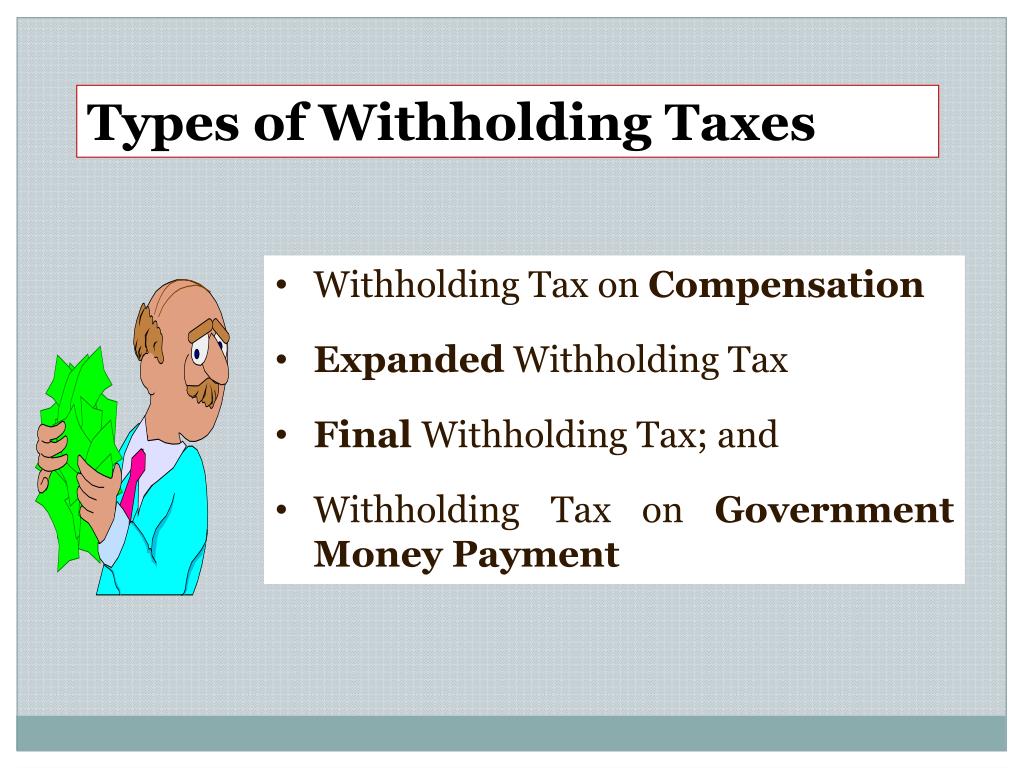

The different types of withholding tax are Resident Withholding Tax (RWT) and Non-Resident Withholding Tax (NRWT). Approved Issuer levy (AIL) may be paid as an alternative to NRWT.. Selecting a rate that is too high may mean you are paying too much tax. If you are paying too much RWT, you may get a refund at the end of the year from the IRD.

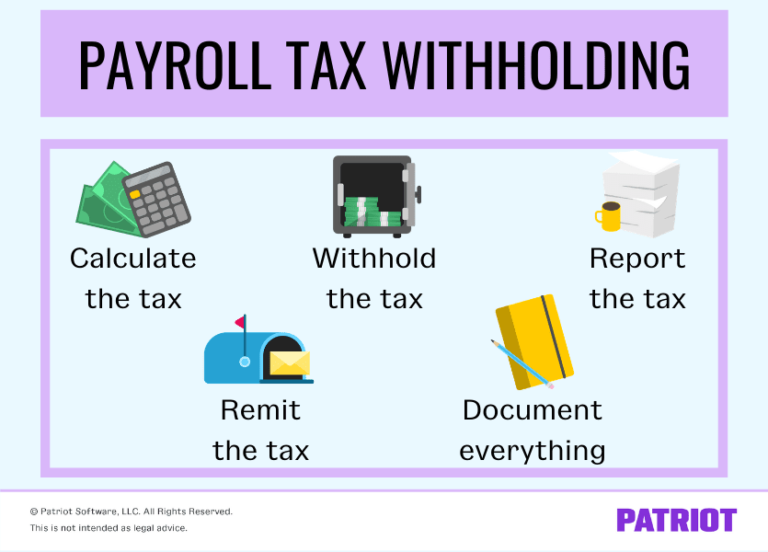

The Basics of Payroll Tax Withholding finansdirekt24.se

A resident of a foreign country under the residence article of an income tax treaty is a nonresident alien individual for purposes of withholding. Married to U.S. citizen or resident alien. Nonresident alien individuals married to U.S. citizens or residents may choose to be treated as resident aliens for certain income tax purposes.

Revised withholding tax table for compensation Withholding tax table, Tax table, Tax

Withholding tax is income tax withheld from employees' wages and paid directly to the government by the employer, and the amount withheld is a credit against the income taxes the employee must pay.

PPT WITHHOLDING TAX AT SOURCE PowerPoint Presentation, free download ID1098893

The ATO explains that if you are a foreign resident, your Australian bank will automatically withhold tax on any interest earned on savings accounts. The rate of tax withheld depends on whether you let the bank know your overseas address. If you provide an address, withholding tax works out at 10%. Without details of your overseas address, tax.

PPT TAXATION PowerPoint Presentation, free download ID638979

Withholding: Definition, Tax Rules, Federal vs. State. A withholding is the portion of an employee's wages that is sent directly to government tax authorities as payment of estimated taxes.

PPT WITHHOLDING TAX AT SOURCE PowerPoint Presentation, free download ID3912928

Tax Withholding. For employees, withholding is the amount of federal income tax withheld from your paycheck. The amount of income tax your employer withholds from your regular pay depends on two things: The amount you earn. The information you give your employer on Form W-4. For help with your withholding, you may use the Tax Withholding.

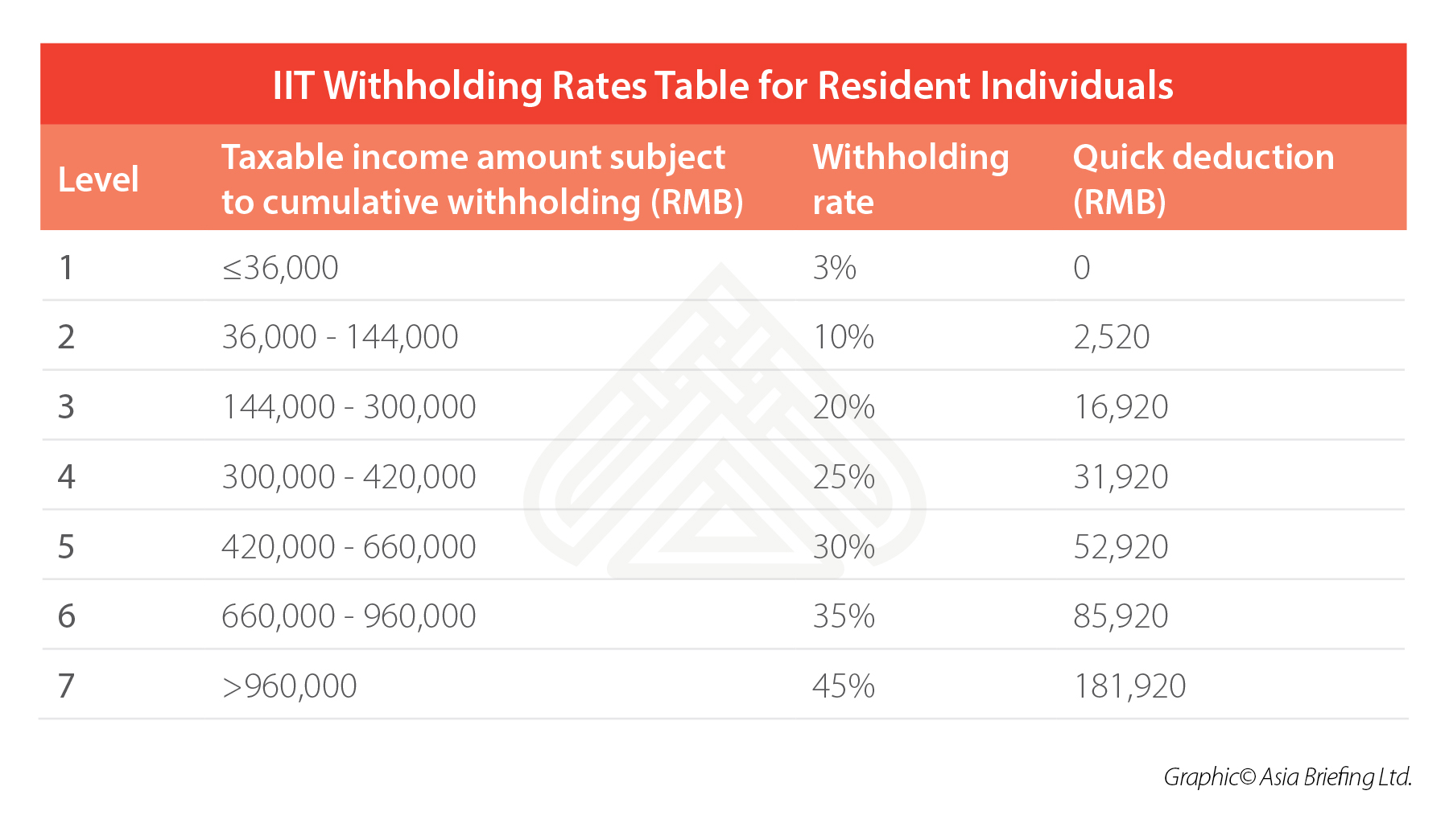

How to Calculate and Withhold IIT for Your Employees in China

It is a tax of 1.45% on your earnings, and employers typically have to withhold an extra 0.9% on money you earn over $200,000. FUTA tax: This stands for Federal Unemployment Tax Act. The tax funds.

Withholding Allowance What Is It, And How Does It Work In, 44 OFF

The non-resident may claim a refund by completing either an IR3NR tax return or a New Zealand non-resident withholding tax refund request - IR386 form. At the end of the tax year. At the end of the tax year we work out if you've paid the right amount of tax. We ask you to check your income tax assessment and tell us about any changes.

- Car Logos With Lightning Bolt

- The Angels No Secrets Lyrics

- Train From Shepparton To Melbourne

- Whats On Melbourne Tv Tonight

- L Infermiera Nella Corsia Dei Militari

- 2000 Royal Visit 50c Coin

- Hobart Beach Campground Bournda Road Bournda Nsw

- Ferry Ticket To Taronga Zoo

- Where To Watch Chris Lilley Shows

- Writers Work Crossword Puzzle Clue