The three stages of an integrated active asset management Download Scientific Diagram

A CGT asset is an "active asset" if it is used, or held ready for use, in the course of carrying on a business by the taxpayer (or their affiliate or an entity connected with them, known as relevant entities). For example, a bricks-and-mortar shop held and used by a green grocer to sell fruit and vegetables is an example of an active asset.

AGIKgqNeLvvl7g9SBc1_pHoGVIEzZJEe7kwqKp6yP39ZLw=s900ckc0x00ffffffnorj

Assets that are used daily by a business to generate revenue are called active assets. The defining characteristic of an active asset is that it plays a functional role in the revenue stream of the business. It can be real property, physical equipment, or something like a patent or copyright. Loss of the asset could potentially interfere with.

(PDF) The Equal Importance of Asset Allocation and Active Management

What is an Active Asset? Active assets are the assets businesses own, and have rights to, which are used for business purposes. Businesses generally use these assets, tangible or intangible, to gain benefits in the future. Active assets can be tangible assets such as real estate or equipment, or intangible assets such as copyrights or goodwill.

Digital Asset Management What Is It & Why You Need DAM

This aspect of the active asset test allows some flexibility in the situation where a business is sold, or has otherwise ceased, and an asset previously used in the business is sold after that time. The asset only needs to be an active asset for half (to a maximum of 7.5 years) of the shorter test period during the total time the asset was owned.

Create Wealth Through LongTerm Investing and ShortTerm Trading The most important chart in

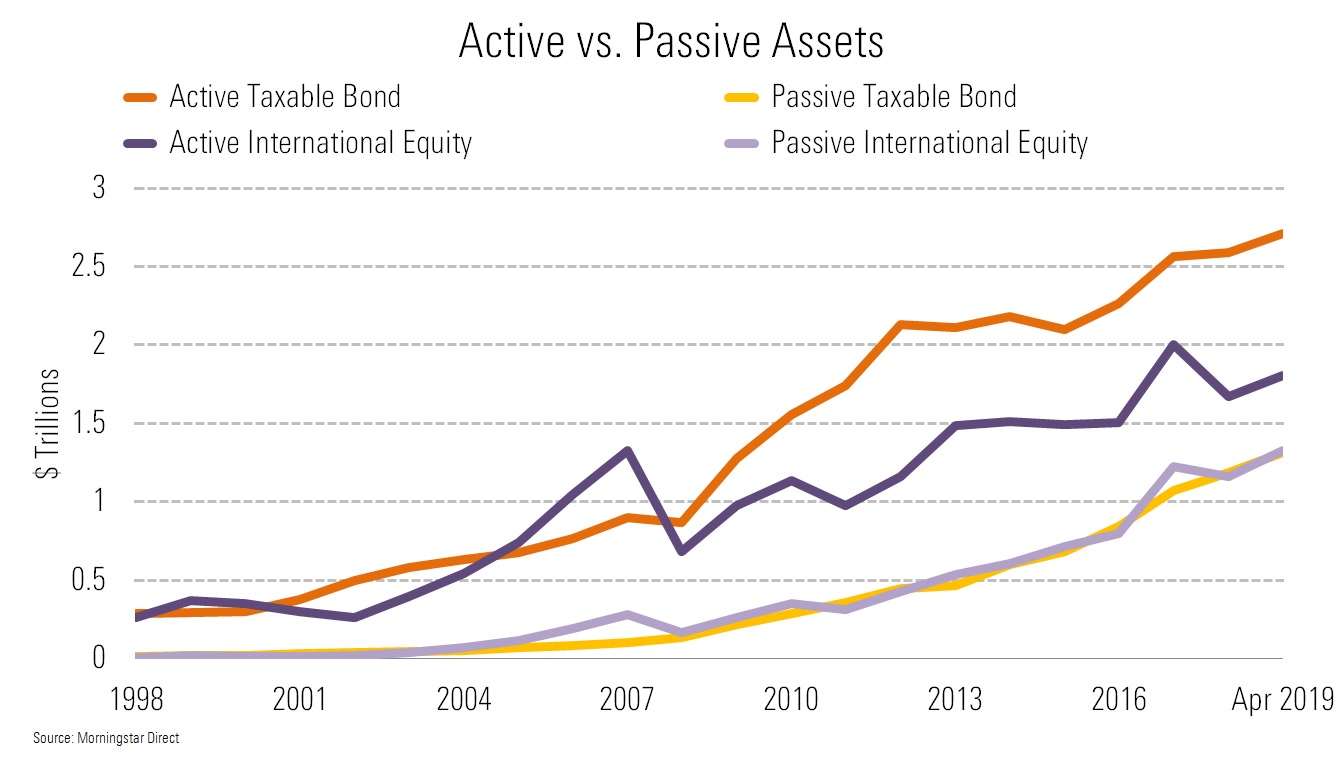

Active asset management and passive asset management are the two primary investment strategies businesses use to generate returns. Active asset investing aims to beat the market, while passive asset investing aims to duplicate the asset holdings of a benchmark. Discover the benefits of each management strategy and how they differ from one another.

What are Fixed Assets Definition, Characteristics and Examples

Active management is an approach to investing. In an actively managed portfolio of investments, the investor selects the investments that make up the portfolio. Active management is often compared to passive management or index investing. Active investors use several different techniques to choose investments. The two most common techniques are:

Investment Management (Active Portfolio Management and Asset Allocation) JHJ Training

Active Assets Accounts, and also to and from external financial institutions linked to your account. eAuthorizations for Wires Electronically approve wire transactions directly on Morgan Stanley Online or via the Mobile App. With eAuthorizations, you no longer need to sign a paper Letter of Authorization (LOA) to authorize a wire transfer request.

Asset Management System Amiro Technology Sdn Bhd

The asset must have been active for the lesser of 7.5 years and one-half of the relevant ownership period. This means that, if an asset has been an active asset for at least 7.5 years, it will be an active asset indefinitely, regardless of when it's sold or any other uses of the asset. In addition, if an asset is used or held ready for use by.

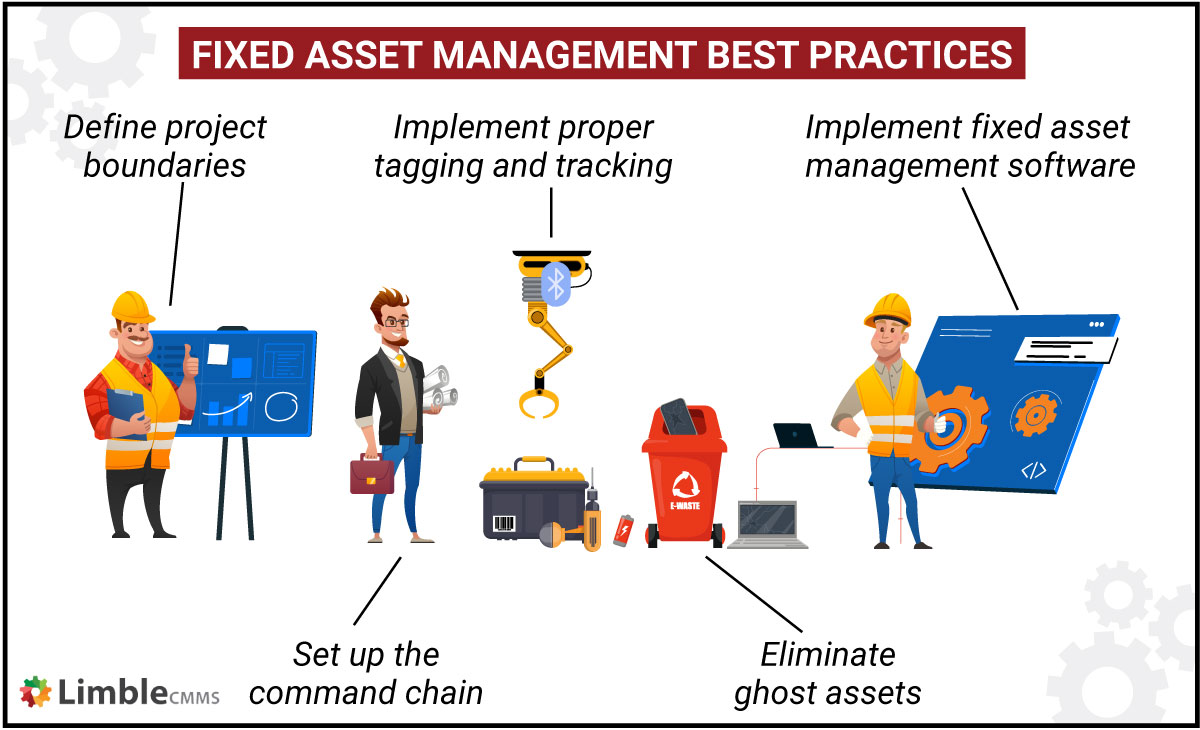

Fixed Asset Management 101 How to Maximize Value

What is an active asset? Active assets are the assets businesses own and have rights to, which are used for business purposes. Businesses generally use these assets, tangible or intangible, to gain benefits in the future. Active assets can be tangible assets, such as real estate or equipment, or intangible assets, such as copyrights or goodwill.

Active vs Passive Investing What's the Difference? WealthDesk

Because Lana has owned the land for more than 12 months and meets the basic eligibility conditions, she is eligible for the: small business 50% active asset reduction. She can reduce her capital gain as follows: $14,000 (net capital gain) × 50% (CGT discount) = $7,000. × 50% (small business 50% active asset reduction) = $3,500 (capital gain)

A Look at the Road to Asset Parity Between Passive and Active U.S. Funds Morningstar

It represents the opportunity for market timing. Active managers could seek to add value by trying to take advantage of the market's ups and downs. Of course, trying to time the market is risky. Dispersion is the variability of individual stocks' returns around the market's return. It represents the opportunity for stock selection.

Active Asset Allocation Pecaut Wealth Management

Sébastien Page is the author of Beyond Diversification: What Every Investor Needs to Know About Asset Allocation and co-author of the book Factor Investing and Asset Allocation. On Investing is an original podcast from Charles Schwab. If you enjoy the show, please leave a rating or review on Apple Podcasts.

Active Asset Allocation Solutions

Active discovery requires more effort upfront than passive discovery. On the other hand, passive discovery takes more time as the results are less comprehensive and rely on existing data or require devices to send signals. The type of data you need to collect should also factor into your decision-making process.

Asset allocation for NPS equity or debt / active or auto? Arthgyaan

An active asset constitutes any tangible or intangible resource utilized by a business to facilitate its routine operations and revenue generation. These assets are prominently featured in a company's balance sheet under the asset section. Tangible active assets encompass physical entities like buildings, machinery, and equipment, whereas.

Asset Allocation Between Active and Passive

Active Assets Accounts (AAA): The AAA is Morgan Stanley's primary brokerage investment account available for individuals, trusts, businesses and government entities/municipalities. The AAA provides clients the ability to invest in available securities and a full range of financial products. The

Active Asset Allocation in 2018 YouTube

Active Asset: An asset that is used by a business in its daily or routine operations. Active assets can be tangible, such as buildings or equipment, or intangible, such as patents or copyrights.

- 1956 Mercedes 300 Sl Gullwing

- Regal Plaza Hotel Residence

- American Cocker Vs English Cocker

- When Are Ps Plus Extra Games Announced

- Lyrics River Of Dreams Billy Joel

- Warners At The Bay Hotel Photos

- 2007 Ktm Exc F 250

- The Hobbit The Desolation Of Smaug Actors

- Bora Bora French Polynesia Map

- When Was The Claremont Serial Killer Caught