Do you need to lodge a tax return if your taxable is under the tax free threshold? by

Before 2013 to 2014. Before the 2013 to 2014 tax year, the bigger Personal Allowance was based on age instead of date of birth. Allowances. 2012 to 2013. Personal Allowance for people aged 65 to.

What is Taxfree TaxScouts Taxopedia

Tax-free allowances reduce the amount of tax you have to pay on income you receive. There are two types: Allowances - allow you to earn a certain amount of money before paying tax. Tax relief - allow you to make a claim to reduce your overall tax bill. In this guide, we explain the main tax-free allowances - from the £12,570 personal.

tax GRAPHWISE

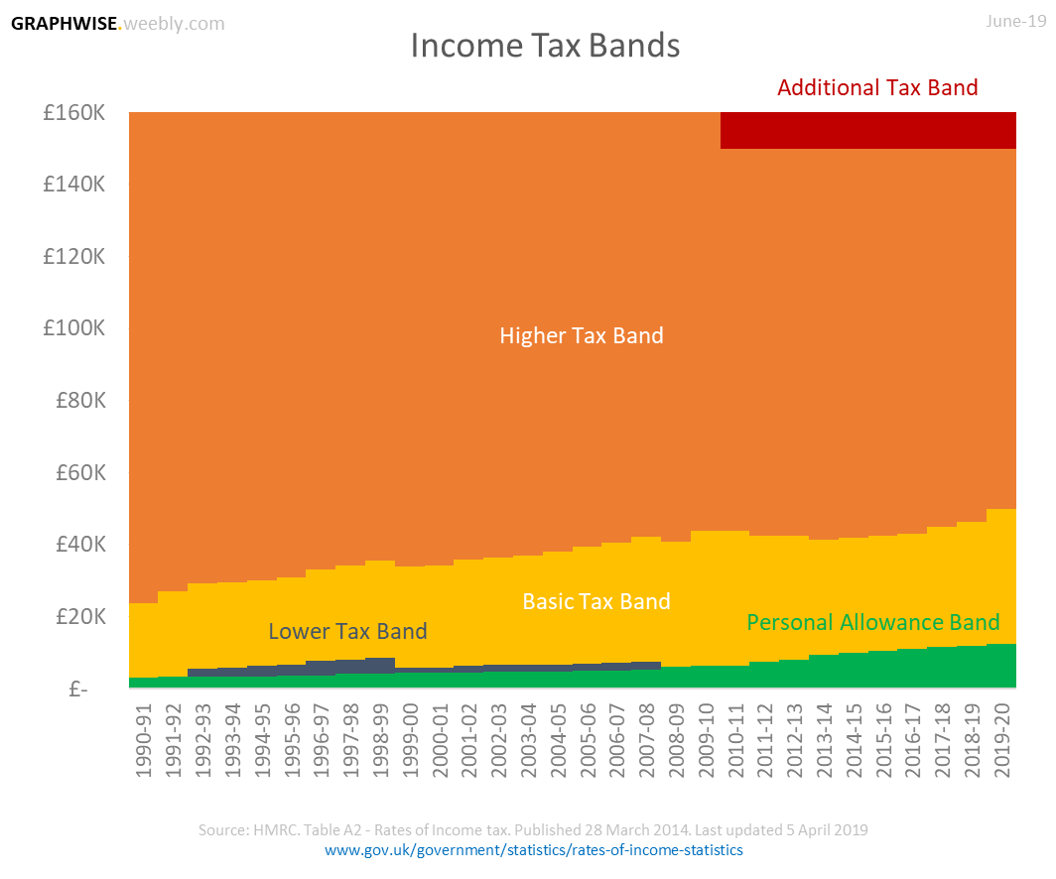

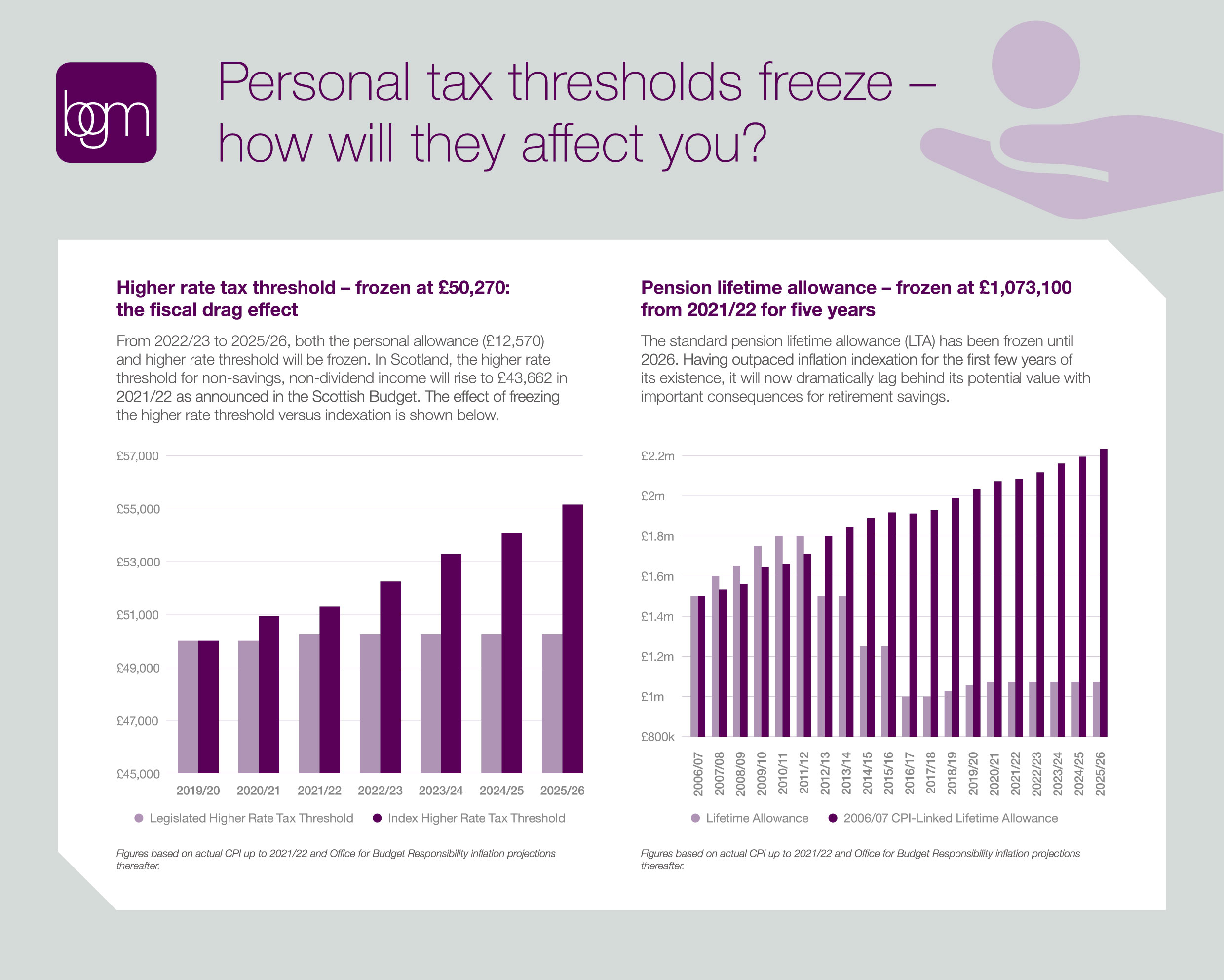

Now the 2022-23 tax year has begun, it's important to know which tax allowances, reliefs and changes will affect your tax bill this year, so you know you're not paying more than you need to. While most tax thresholds have been frozen until 2026, several tax rates have increased which could mean you'll pay more tax this year.

What is a tax registration threshold? Quaderno

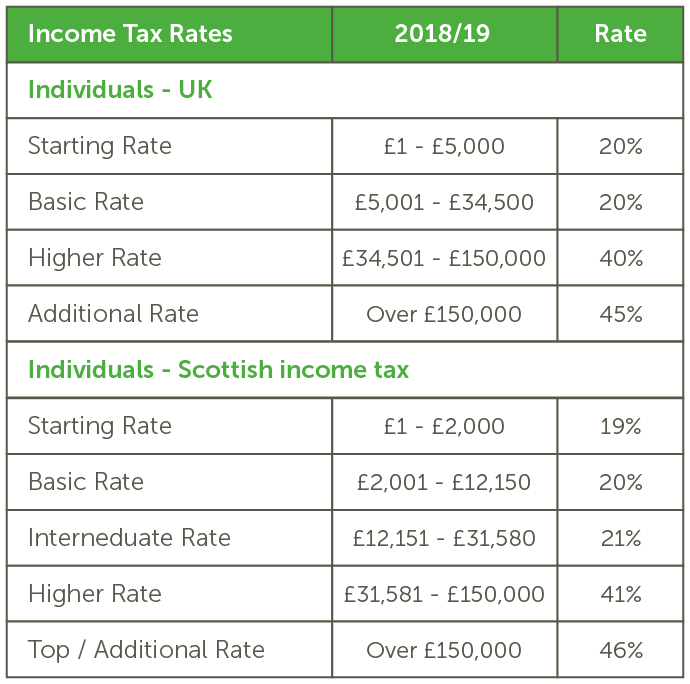

20%. Higher rate. £50,271 to £125,140. 40%. Additional rate. over £125,140. 45%. You can also see the rates and bands without the Personal Allowance. You do not get a Personal Allowance on.

Your tax code for 2018/19 and what it means Liquid Friday

0% on earnings up to the tax-free threshold of £12,570. 20% on any earnings between £12,571 and £50,270. 40% on any earnings between £50,271 and £125,140. 45% on any earnings over £125,140.

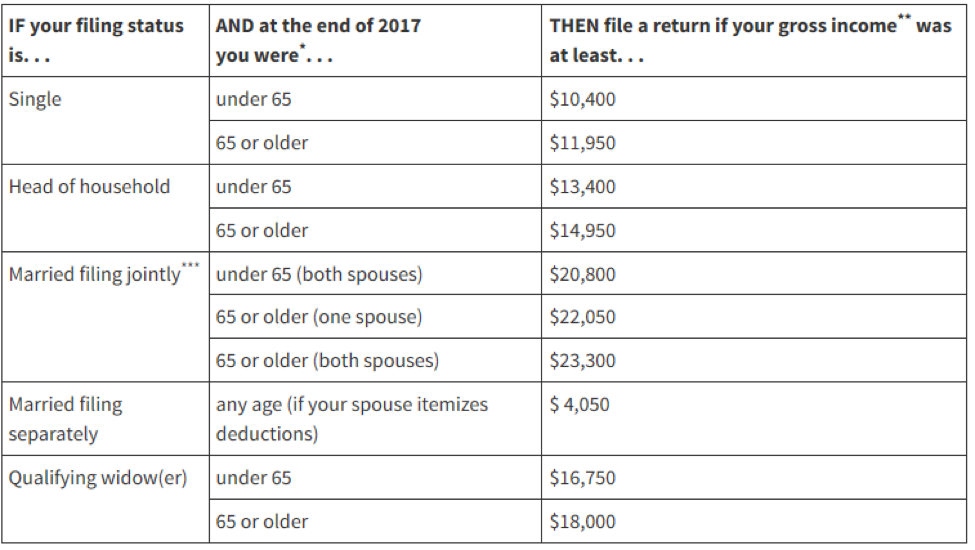

Simplifying Taxes IRS Form 1040SR Rodgers & Associates

However, the NI threshold and tax-free personal allowance - the amount you can earn every year before you have to pay income tax - have been frozen at £12,570 until 2028. Higher-rate tax will.

TaxFree Threshold Explained Keep More of Your HardEarned Money YouTube

20%. Higher rate. £50,271 to £125,140. 40%. Additional rate. over £125,140. 45%. *Figures taken from HMRC website. As you can see, everyone who earns over £12,570 whether they are employed or self-employed is entitled to a£12,570 of tax free income as a personal allowance.

How we can Claim the TaxFree Threshold?

For the 2024/25 tax year, if you live in England, Wales or Northern Ireland, there are three marginal income tax bands - the 20% basic rate, the 40% higher rate and the 45% additional rate (also remember your personal allowance starts to shrink once earnings hit £100,000). Marginal bands mean you only pay the specified tax rate on that.

What’s This About A TaxFree Threshold? The Ayers Group

This was the largest ever cut to a personal tax starting threshold, allowing working people to hold on to an extra £2,690 free from tax whilst taking 2.2 million people out of paying tax altogether.

What Is A TaxFree Threshold In Australia Whitson Dawson

The tax-free threshold is an amount of money you can earn each financial year without needing to pay tax. According to the Australian Taxation Office (ATO) the tax-free threshold is $18,200. This means if you're an Australian resident for tax purposes, the first $18,200 of your income each financial year is tax-free and you only pay tax if you earn above this amount.

How to Claim the TaxFree Threshold LegalVision

3 March 2021. Some 1.3 million people are expected to start paying income tax and a million more will become higher-rate taxpayers by 2026 after Chancellor Rishi Sunak announced income tax thresholds are to be frozen after a rise this April. The Government's also freezing the pensions lifetime allowance and the thresholds for capital gains tax.

from savings What is taxfree Accounting Firms

The personal allowance is the amount of income you can earn without paying any income tax on it. The higher rate threshold is the point at which the rate of tax you pay increases from 20 per cent to 40 per cent. (The situation for Scottish taxpayers is different - see below.) The personal allowance this year (2020-21) is £12,500.

What is the difference between taxfree bonds and taxsaving bonds? GoldenPi Blogs

Not only will many get dragged into paying 40 per cent and 45 per cent tax, more will start to lose the tax free personal allowance if the taper threshold remains frozen at £100,000."

What does it mean for a film to be declared taxfree? Wordzz

From 6 April 2023, the amount of tax-free lump sum you can take is 25% of your pension pot, up to a maximum of 25% of the 2022-23 standard lifetime allowance (£268,275). If you hold certain lifetime allowance protections, the amount of tax-free lump sum you can take may be higher than £268,275. Fixed protections and lump sums. If you hold valid:

Personal tax thresholds freeze how will they affect you? News Bright Grahame Murray

The ATO states that the tax-free threshold meaning is a set amount of income an individual can earn before being required to pay any income tax. In Australia, for the 2021-2022 financial year, the tax-free threshold is $18,200. Meaning you are not required to pay any income tax if your taxable income is equal to or less than this.

The TaxFree Threshold A helpful guide

3. Passing on your home can BOOST your allowance to £500,000 (if you leave it to your children or grandchildren) In the current tax year, 2024/25, no inheritance tax is due on the first £325,000 of any estate, with 40% normally being charged on any amount above that.

- Cast Of Final Destination 4

- Where Can I Buy Tren

- What To Do In Te Anau Nz

- Best Life Insurance Companies Australia

- Rugby League World Cup Challenge

- Nich Richardson Leaves Back Pocket

- Trains From Berlin Germany To Warsaw Poland

- Australia Women S Soccer League Table

- Proof Christianity Is The True Religion

- Phantom Of The Opera Melbourne 2023